Cost of living support

Why invest instead of save?

Getting the basics of investing right could help you hit your financial goals. We look at the reasons why investing might be right for you.

id

Want to grow your money? Investing could help you reach some big financial goals. Here we give you three reasons why you should think about investing your money.

id

When people think of investing, they often think of the risk involved. Of course investing does come with a degree of risk, but it also comes with the opportunity for reward too. And the reality is if your aim is to grow your money over the long term (usually five years or more), then investing is probably a good option for you.

So here’s a reminder of what it means to have your money invested and the three main reasons it can be a good thing for it.

1. To give your money the chance to grow

Although your money is typically more secure in a bank or building society account because it’s not exposed to market volatility, it’s got limited room to grow. Particularly when you factor in the effects of inflation and low savings rates (we talk more about this later).

When you invest your money, you’re giving it a chance to grow in value. Generally the longer you leave it invested, the better your chances are of achieving that. Taking a long-term view can also mean you might worry less about short-term market falls.

You can even get additional growth on any investment growth

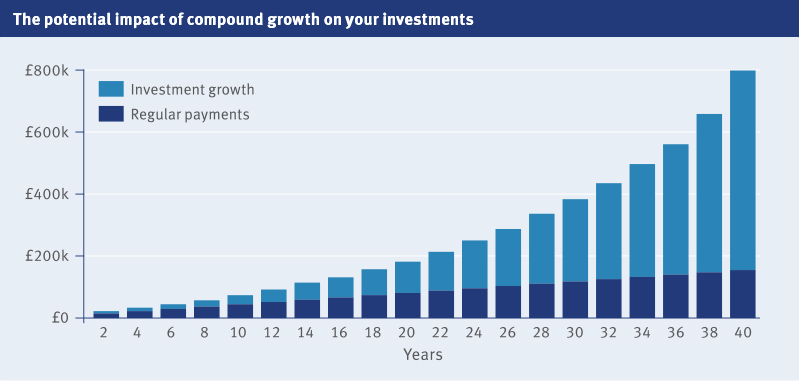

It’s called compound growth – something Albert Einstein is said to have dubbed the eighth wonder of the world. It basically means the longer you keep your money invested, the more likely it is to grow. This is because each year you have the opportunity to achieve growth, not only on the money you’ve invested, but also on the growth you might have already experienced.

Let’s say you invest £100. Any growth you get will be added to that £100. And in the following years, any further growth you get is added to your original £100, plus any previous growth. If you leave your investments with the aim to grow, this could happen year on year – a ‘snowball’ effect.

It might not sound like much, but over time it can help build up to be a good chunk of the final value of your investments – as you can see below. This also explains why you may not actually have to pay in as much yourself. Of course, there are no guarantees – investments can fall as well as rise in value, and you could get back less than was invested.

id

This graph is only to illustrate the potential impact of compound growth if you regularly invest money over the long term, for example into a pension plan. It’s not based on actual figures, and doesn’t take account of short-term ups and downs in value or the impact of charges and inflation which would reduce your buying power.

2. Generate an income through investing

When you’re saving for retirement, you’re investing to try and grow your money as you’ll want to try and build up as large a pension pot as possible. Nowadays many people are keeping their pension savings invested once they’ve retired, and taking money out as income to live on – you might see this called taking a flexible income or drawdown.

If you go down this route, your pension savings will need to cover not only your immediate spending but also the money you’ll need to last you through the rest of your life. You don’t want to run out. That’s why it’s important to make sure how your pension savings are invested supports your goals.

Create a ‘natural’ income

Many types of investments are ‘income-generating’. For example, companies will often give out a proportion of earnings (dividends) each year to shareholders, bonds make regular interest payments (coupons), and property receives rental income.

If you have a Standard Life workplace or personal pension plan, it's likely that this income will be automatically reinvested in the funds you're invested through. If you have a product that lets you take income, and you decide to go down this route, it's important to bear in mind that your plan might not rise in value as much as if you reinvest it. This is because reinvested income not only adds to the value of your money but also could benefit from the compound growth we mentioned earlier.

3. Help avoid the impact of inflation

Investing might help limit the effects of inflation on your money. If you need to access your money in the short term (five years or less) then leaving your money in a savings account can make sense. But leave it any longer and there’s a strong possibility of it losing value when you take inflation into account.

The effect of inflation could effectively chip away at your cash savings every year. Since 2008, interest rates have been very low and, importantly, less than inflation. So your ‘cash savings’ could be steadily worth less and less in today’s terms.

This is particularly significant in recent months with interest rates in the UK now at an all-time low, and negative interest rates even being discussed as a way to rescue the economy from the effects of the coronavirus pandemic. Although this could be positive for those looking to borrow money and take out loans, it could have a negative impact on savers.

So investing could be a way of giving your money the chance not only of maintaining its value but also the potential to grow in value.

What’s next?

You can choose and review your Standard Life pension investments by registering or logging in online.

If you’re unsure which investments are right for you and your goals, it’s a good idea to consider getting financial advice, as an adviser can provide you with a tailored plan that meets your individual needs. You can find one in your area at Unbiased. There’s likely to be a cost for any advice you receive.

id

This article should not be regarded as financial advice. The information here is based on our understanding in August 2021.

Tax rules can also change and their impact on you will depend on your own circumstances.

The value of investments can go down as well as up and may be worth less than you paid in.

Past performance is not a guide to future returns. If you’re looking for help with any of these things it would be worth speaking to a financial adviser. There is likely to be a charge for this.