What is a bond?

Bonds are sometimes known as fixed income or fixed interest investments. Essentially, when you invest in a bond you’re:

- loaning your money to a government or company that needs to raise money

- usually investing for a fixed period of time and get your initial “loan” amount back at the end of that period

- also hoping to receive a regular interest payment, usually known as coupons, on top of your initial payment

- looking for an investment type that could be less risky than equities

Bonds aren't risk-free and unless you buy a guaranteed bond there’s a chance that you won't get back what you originally paid.

Why would you invest in bonds?

Investing in bonds as well as other types of investments could be a good way to lower the overall risk of a portfolio.

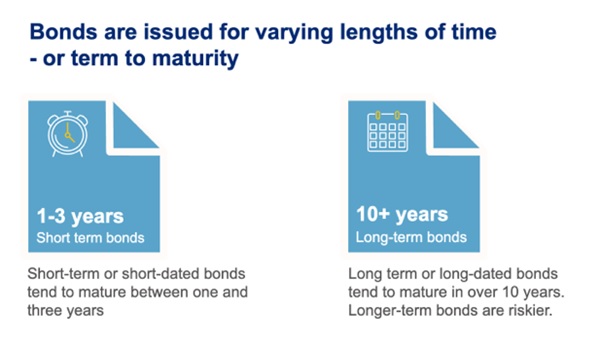

Bonds tend to behave differently to equities, so they can be good for helping to spread risk. Historically, bonds have been less volatile than equities. However, there aren’t any guarantees: sometimes they can be very risky and the most risky types (long-term and high-yield bonds) can be as or even more volatile than some equities.

Bonds can give you a steady and defined income, as you'll get a fixed level of interest. However, that’s only if you hold them directly by buying and selling them yourself at their redemption date. Bondholders are ahead of shareholders in getting their money back if a company goes into liquidation, although this might not always be the case if you’re investing through a fund.

Why you might have bonds in your pension investments

Bonds are often used to help spread the risk in people’s pension investments as they get closer to retirement. Long-term bonds specifically are used where people plan to buy a guaranteed income for life (annuity) with their pension pot when they retire.

Buying an annuity is a way of turning your pension savings into a regular income that will continue for the rest of your life. The price you pay to buy an annuity is affected by changes, such as those in long-term interest rates.

So, an annuity targeting fund mainly invests in bonds whose prices are normally expected to go down and up broadly in line with the cost of buying an annuity. By doing this, the fund aims to lessen the impact of changes in long-term interest rates when you come to buying an annuity.

While this type of fund will try and make sure you get the best annuity possible, your pension savings will still be exposed to risk. Long-term bonds span a long investment period – and nobody knows what the future will bring.

How to invest in Bonds

While you can invest directly into bonds, it’s not the simplest thing to do. It can also be a risky strategy to have all your money in one government’s or company’s bond. Because of this, many people choose to invest through funds. That way your money is pooled with other investors’ money to buy a range of bonds. You can also choose funds which include a range of investments, not just bonds.

There’s also the added benefit of having an experienced fund manager invest and manage your money for you.

Find out why it can be a good idea to have a diversified range of investments in our helpful guide.

Not all bonds are the same

Bonds issued by the UK government are known as gilts, while bonds from companies are called corporate bonds. Other government bonds you may hear about in the media are US treasuries and German bunds.

id

id

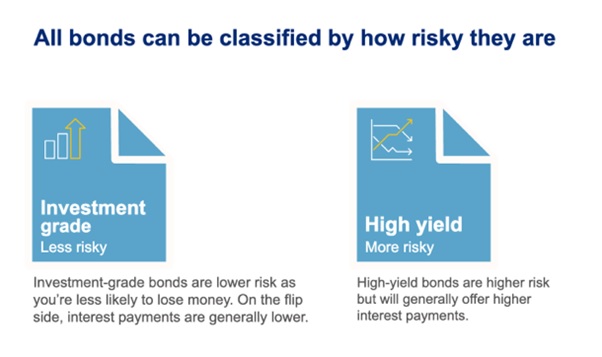

And, there’s a system to help identify which bonds are safest and which are more risky:

id

id

Government bonds tend to be AAA or AA-rated as they're seen to be higher quality, and are thought to be safer option than corporate bonds. For example, it’s very unlikely that the UK government would ever avoid paying bondholders.

Bonds with a rating of BBB or above are considered to be investment grade. Bonds with an even lower rating are considered high yield. Always remember, some companies and even governments in more volatile countries might not be able to pay you back.

Getting a bit more technical: why fixed isn't always fixed

When you buy a bond, you’ll either:

- buy it at a fixed price when it’s issued

- or, you’ll trade with other investors at the current market price

Unless you buy a bond when it’s issued, the price you pay can change depending on a few factors.

1. How interest rates and duration can be useful indicators

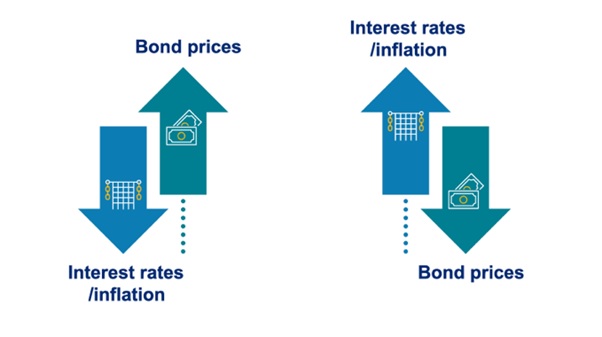

Interest rates are usually set by central banks, which use them to help manage the economy. Typically, when interest rates are low, bond prices are high and vice versa. However, different types of bonds are more sensitive to interest rate movements than others.

2. How inflation impacts bonds

When you buy a bond, it usually promises fixed interest payments. When the cost of everyday items goes up (known as inflation), it can mean that the payments won’t be worth as much. As a result, the prices of bonds tend to go down as they’re less attractive. On the other hand, if inflation is low, bond interest payments will be worth more. This means that the price of bonds tends to go up as they’re more attractive.

id

id

3. Why changes in supply and demand matter

If there’s a sudden rise in the number of companies or governments that need to borrow money, it can mean there will be plenty of bonds for investors to choose from. In this case, bond prices are likely to go down. But, if there are more investors wanting to buy than there are bonds available, prices are likely to go up.

4. How credit risk can affect bond prices

If the credit rating of a bond rises there could be more demand, meaning prices are likely to rise. On the flip side, if the credit rating falls, the rise in sellers will push prices down.

id

A bond's yield can suggest how attractive it is

You may have heard of yield being mentioned in relation to bond markets. Put simply, yield is a measure of how much profit you’ll make from your bond investment.

The yield is based on:

- The current price of the bond

- Its regular interest payment (the coupon)

- How long until it reaches its full term (redemption date)

- The type of bond - some bonds pay a flat rate of interest, while others increase interest payments in line with the retail prices index (RPI) or another index - so make sure you check

The main thing to remember is that a bond’s price acts in the opposite way to its yield. If the price goes up, the yield goes down and vice versa.

Liquid markets could impact your ability to sell a bond

In relation to bonds, liquidity simply means that there are enough buyers if you want to sell a bond. When the market becomes illiquid, it suggests that there’s a lack of buyers. So if you want to sell, you may not be able to.

Or if you need to sell, you might have to do so at a price much lower than market value. The sign of an illiquid bond market tends to be when the gap between the prices at which bonds are bought and sold widens.

This information is to help you understand more about bonds, how they work and why you might want to invest in them. Please remember though that the information here shouldn’t be regarded as financial advice.

More about investments

We have many guides, tools and articles that can help you understand investing and support your long-term goals.

-

Investment basics

Investing can be a great way to help you meet your financial goals and save for the future you want.

-

Diversification

Learn why it’s a good idea to diversify your investments.

-

MoneyPlus

Get regular investment insights, analysis and more from the MoneyPlus experts.