- Pensions

- Personal Pension

Our Personal Pension

Money invested is at risk

If you want choice and flexibility like a SIPP, but in a simpler low-cost option, our Personal Pension could be right for you.

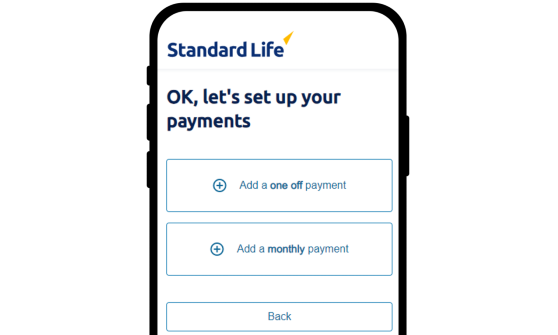

Flexible payments

Open a personal pension with us from as little as £1.

Pay in to your pension when you want - monthly or one-off. Stop or start whenever you like.

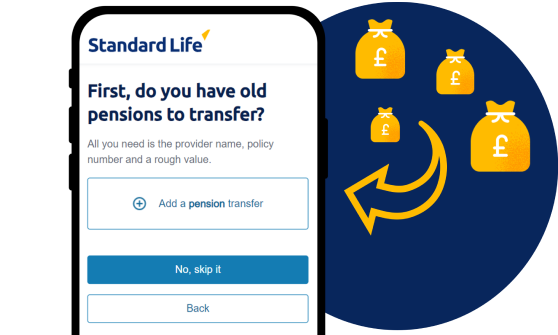

Pension transfers

Bring old pensions together easily - workplace or personal.

We never charge you for transfers. All you need is the provider name, policy number, and a rough estimate of the value.

Transferring may not be right for everyone.

No hidden charges

- No exit fees

- No charge to switch investments

- No charge to take money out

- No charge to transfer in (your old provider may charge an exit fee)

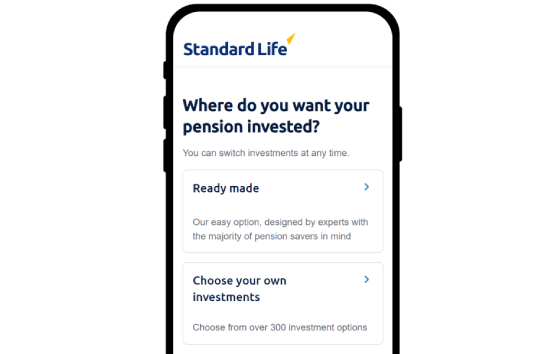

Easy investment options

We have two options for investing in your personal pension:

1. Ready made - Our easy option, designed and managed by experts

2. Choose your own - select from over 50 investment options

A pension is an investment, its value can go down as well as up and could be worth less than was paid in.

Withdrawing your money

When you reach age 55 (57 from 6 April 2028), you'll be able to take money from your personal pension in a mix of ways - and 25% is usually tax-free.

- Take lump sums

- Take a flexible pension income

- Buy a guaranteed income (annuity)

It's up to you. We'll never charge you for withdrawals.

Self-employed?

Our Personal Pension can also help if you're self employed - including sole traders and directors of limited companies.

- Payments from personal or business accounts

- Automatic tax relief

- Pay in from the app, anytime

Call our qualified pension experts

We've been around for 200 years, so we know pensions.

Our pension experts are based in the UK and are ready to help you.

Need help with your application? Call us on 0345 279 8858

Open a personal pension today

Apply online or call our pensions experts on 0345 279 8858

Call charges will vary.

Money invested is at risk

-

A personal pension is normally set up by you instead of your employer.

Anyone can open a personal pension, and you can have more than one. They can be used by people who are self-employed, or directors of limited companies, who don’t have access to a workplace pension.

There are different types of personal pension. As well as our Active Money Personal Pension, we also offer a stakeholder pension and a SIPP (self-invested personal pension).

-

A SIPP is for experienced investors who want access to a wide range of investment types like mutual funds or specific investments like commercial property and gold bullion.

They are designed for those who are comfortable regularly reviewing their pension investments.

-

We've been looking after people's money for 200 years.

Our personal pension offers flexible withdrawals, and our app makes it easy to stay on top of things.

We also offer free retirement webinars, and our UK-based pensions experts are just a phone call away if you need support.

-

When you die, any remaining pension pot can be passed to your beneficiaries normally inheritance tax-free.

- If you die before age 75, this will normally be free of income tax.

- If you die after age 75, this will normally be taxed as income at the beneficiary’s marginal rate.

From April 2027, the government have announced their intention to include unused pension savings when calculating the value of estates and could be subject to inheritance tax. The full details of how this will work are still to be confirmed.

It’s important to nominate a beneficiary so we know who to pass your personal pension on to. With Standard Life you can do this in the app or online – it only takes a couple of minutes.

-

There’s an estimated £26 billion in lost pensions in the UK. When you house or move jobs, it’s easy to lose track, so it’s worth double-checking. The government’s Pension Tracing Service can help if you think you may have missing pensions you could transfer. You can also get in touch with your provider or with previous employers.

-

You can use the Standard Life app or log in via a computer to make payments, manage your pension investments, or just keep an eye on things. You can send us a secure message if you have questions about your personal pension.

We also have UK-based phone support from qualified pension experts. Call us on 0800 970 4131 to speak to one of our team. Call charges vary. Our opening hours (including on bank holidays) are:

Monday: 9am to 5pm

Tuesday: 9am to 5pm

Wednesday: 10am to 5pm

Thursday: 9am to 5pm

Friday: 9am to 5pm -

Cash accounts can hold money prior to investing or when making a withdrawal. For certain products they are also used to pay charges.

Read our Interest Rates and Charges for Cash Accounts page for more details.