Financial Wellness

Why have only 30% of people done a lot of retirement planning?

For the third year running, we found that most people aren’t planning a lot for their retirement. Widespread guidance must be part of the solution.

id

For the third year running, we found that most people aren’t planning a lot for their retirement. Widespread guidance must be part of the solution.

People who plan generally experience better financial wellbeing and retirement outcomes. This is true across generations, genders and income levels.

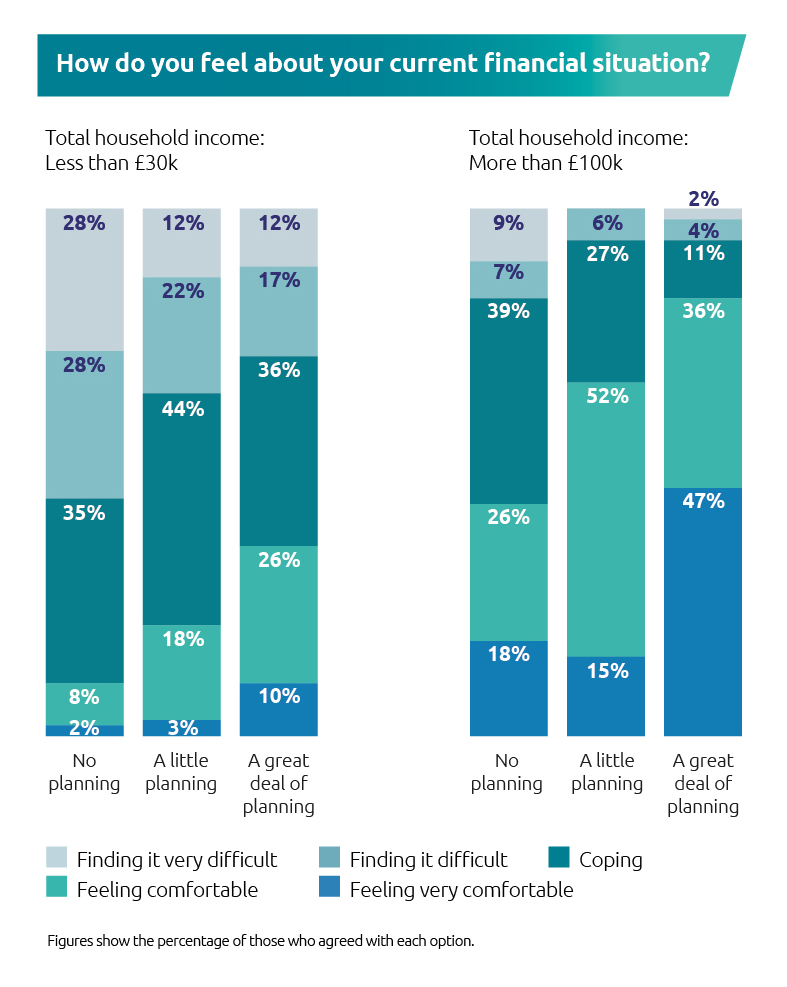

Planners are around three times more likely to feel positive about their current financial situation than non-planners (61% vs. 21%).

For people on lower incomes, financial planning also appears to provide benefits (see Figure 1). Among those with total household incomes of less than £30,000, people who do a great deal of planning are more than three times as likely to describe their financial situation as “comfortable” than those who do no planning (36% vs. 10%).

These findings are from Standard Life’s Retirement Voice 2023 report, where for the third year running, we surveyed the views of around 6,000 people in the UK from all walks of life1.

Figure 1: Financial planning appears to provide benefits across all incomes

Our research also indicates that people benefit from supplementing their own planning activities with guidance, from sources such as the Money and Pensions Service or Pension Wise.

Compared to those who look after their own planning, those who use guidance are more likely to say they understand financial products (81% vs. 64%). They also feel more confident about how they’ll access their pension savings.

Despite these benefits, just 29% of people say they’ve done a “great deal” of retirement planning. This picture hasn’t changed significantly since 2021.

People aged 43–58 (21%), those with household incomes of less than £30,000 (22%), and women (24%) are among the least likely to be planning for their retirement.

Why is this?

Feeling overwhelmed

One of the biggest barriers to planning appears to be that people just don’t know where to start.

Half of the country (49%) say they find the amount of information they receive about their pensions “overwhelming”.

With respect to their pension savings, the information people want to know about most is:

- How much they have in their pension pot

- What income this might potentially give them in retirement

Consolidating their pensions could help provide this information – and in turn encourage more people to plan for their retirement.

Yet only one-in-five people consolidate their pensions, with the main barriers for doing so being:

• Not knowing how to consolidate (25%)

• Being uncertain whether the savings are better staying as they are (17%)

• Worrying about making a mistake (13%)

Combatting the guidance gap

As more people struggle through the cost-of-living crisis, financial planning arguably has an even more critical role to play in helping them manage not just their financial pressures, but also the potential adverse mental and physical effects of financial worry.

Against this backdrop, we need to do even more to give people the tools to plan for their retirement, while promoting the benefits of seeking guidance or advice.

Ultimately, however, we must make support available to whoever needs it most. And this has to come in a form that’s personal, relatable and engaging. Only then can we hope to foster better financial and social wellbeing for all.

Get the full report

To dive deeper into our research, download our Retirement Voice 2023 report.

1Between July and September 2023, Standard Life commissioned an independent study that sought to understand consumer attitudes to pensions and retirement plans. The study questioned a total of 6,350 UK adults, with the data weighted to give a nationally representative sample by age, gender, region and working status. The research sample included UK adults aged 18–80 and covered a range by income, savings, region, gender, ethnicity, and other key attributes.