Financial Wellness

How financial attitudes changed in 2023: survey results

How do people in the UK feel about their finances? And how is the ongoing economic uncertainty affecting their plans for retirement? To find out, we surveyed the views of more than 6,000 people from all walks of life.

id

How do people in the UK feel about their finances? And how is the ongoing economic uncertainty affecting their plans for retirement? To find out, we surveyed the views of more than 6,000 people from all walks of life.

Our research indicated three themes of how people felt about their retirement in 2023 and how the cost of living affected their plans for the future:

- The need for financial certainty

- The cost of financial uncertainty

- The power of planning

Below is a summary of these themes, which are explored in more detail in our Retirement Voice 2023 report1.

1. The need for financial certainty

Two-thirds (66%) of people said they had a more cautious attitude towards their finances because of the cost of living. Women were considerably more cautious with their money than men (71% vs. 59%). And Gen Xers (those aged 43–58) appeared to be most cautious of all generations.

Many people said they were looking to cut back on their everyday spending (38%), though the proportion had dropped significantly from 2022 (49%).

People hadn’t yet made significant cutbacks to their pension contributions. However, of those who were looking to make cutbacks over the next 12 months, three-in-ten put pension contributions among their top five cost-saving priorities.

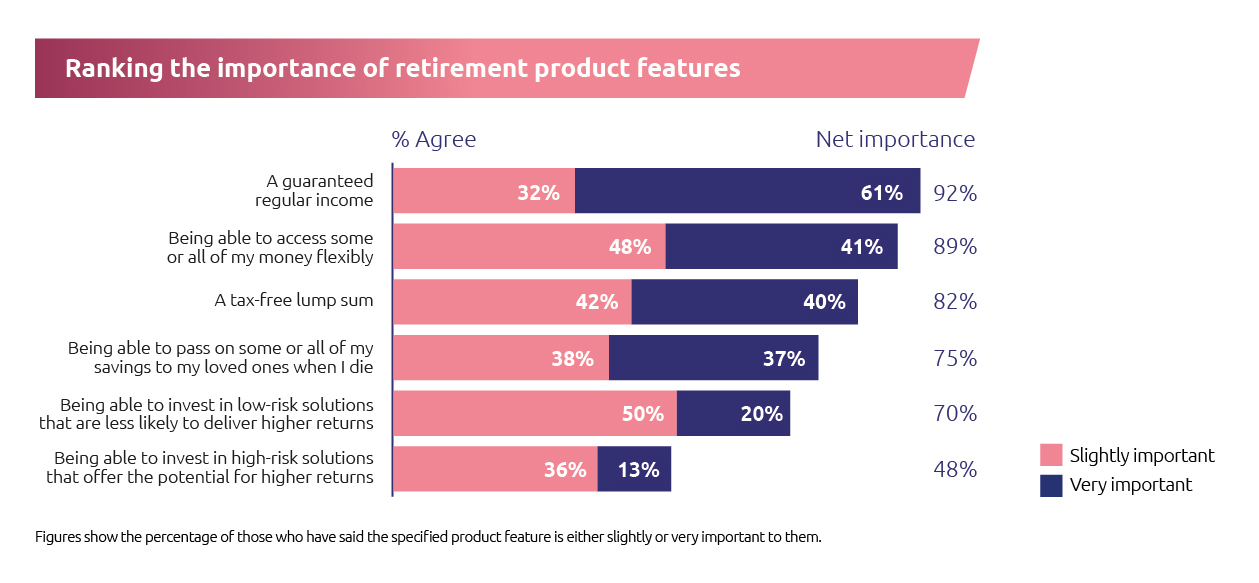

The great majority of people (92%) wanted their pension pot to give them a guaranteed regular income in retirement. However, a similar number (89%) said being able to access some or all of their pension savings flexibly was important.

The significance placed on having certainty of income in retirement was significantly greater among older people.

Figure 1: When it comes to retirement income, most people want both certainty and flexibility

2. The cost of financial uncertainty

Overall, the UK’s financial mood appeared to be no worse in 2023 than it was before the mini-budget in September 2022.

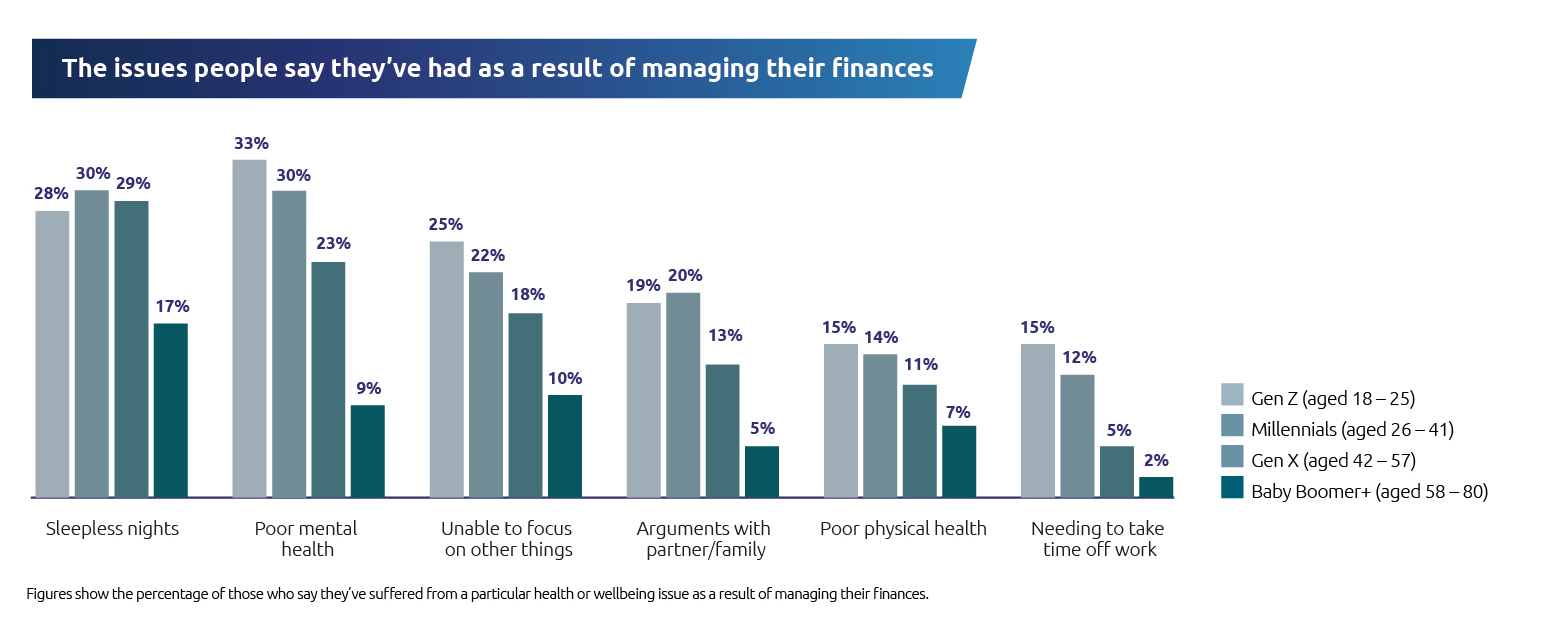

That said, a quarter of people said they had lost sleep as a result of financial pressures. A similar number believed it had affected their mental health. Rising inflation, energy prices, economic uncertainty, and rising interest rates were the main causes of this worry.

In 2023, the nation was also more receptive to taking on debt than in 2022, despite the cost of credit being more expensive. And Gen Xers and Britain’s mixed-race population both felt less positive than the year before. In fact, Gen Xers have consistently felt the least positive about their financial situation – being the only generation to have felt less positive every year since 2021.

Dealing with financial issues was affecting many people’s wellbeing, with the younger generations most likely to say they had suffered from an emotional or health issue as a result (see Figure 2).

Figure 2: Gen Zers and Millennials are most likely to say they’ve suffered as a result of managing their finances

Women were also paying a higher price for the economic uncertainty. Almost half of women feel worried, anxious, stressed or overwhelmed, compared to a third of men.

Women were also paying a higher price for the economic uncertainty. Almost half of women feel worried, anxious, stressed or overwhelmed, compared to a third of men.

Despite many people suffering from mental and emotional problems as a result of financial issues, most people (62%) haven’t looked for support. And, sadly, some groups – such as Gen Xers and women – who are among the most likely to find things difficult are also among the least likely to look for support.

3. The power of planning

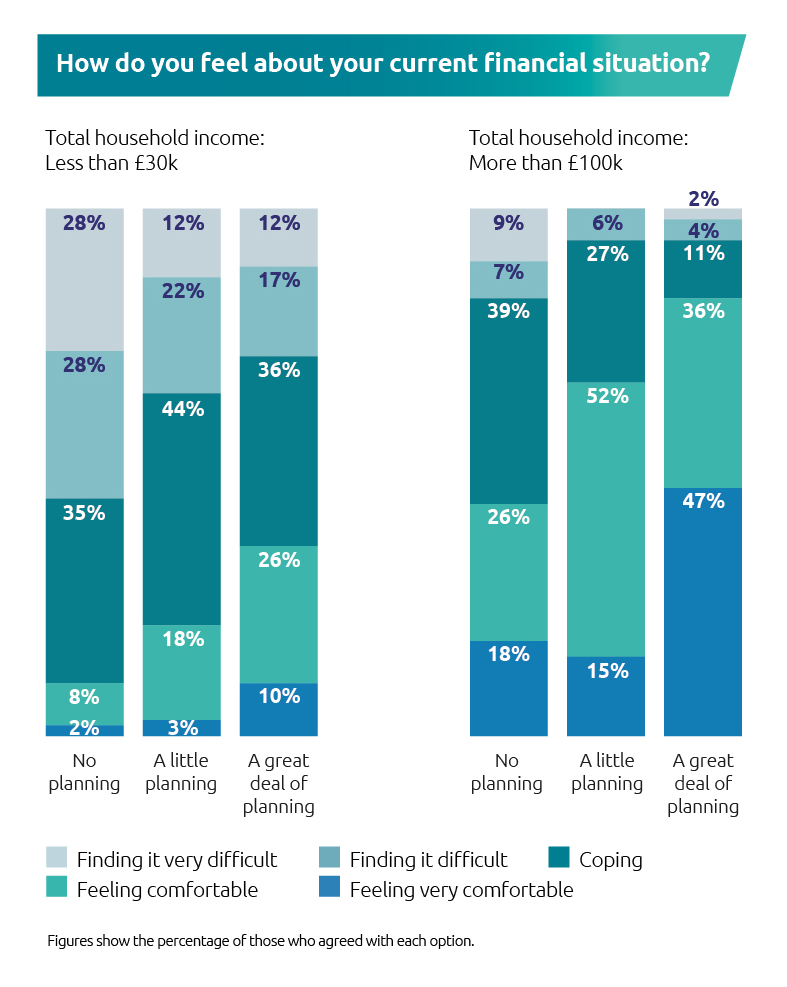

People who planned generally experienced better financial wellbeing and retirement outcomes. This was true across generations, genders and income levels.

Planners were almost three times more likely to feel positive about their financial situation than non-planners (61% vs. 21%).

For people on lower incomes, financial planning also appeared to provide benefits. Among those with total household incomes of less than £30,000, people who did a lot of planning were more than three times as likely to describe their financial situation as “comfortable” than those who did no planning (36% vs. 10%).

Despite these benefits, just three-in-ten people said they had done a great deal of retirement planning. This picture hasn’t significantly changed since 2021.

Figure 3: Financial planning appears to provide benefits regardless of income

How can our industry make a difference?

If we’re to make financial security in retirement fairer and more widespread, we must take the following three steps.

-

Help people feel a little more certainty

It’s encouraging that most haven’t reduced or stopped their regular pension contributions. However, we must not presume this will remain the case in 2024. Instead, we must continue to provide widespread financial education that empowers people to make informed decisions about their short-, medium- and long-term finances.

We’ve recognised that people increasingly want income certainty in retirement and launched a new pension annuity in 2023. However, the benefits of drawdown will always be an attractive proposition for many people. So we must look for ways to make it easy for people to enjoy the benefits of a guaranteed income and an element of financial freedom in retirement.

-

Improve people’s wellbeing

Many people feel anxious just thinking about their finances. Gen Xers, in particular, appear to be struggling. To support this group more we have begun offering our employees Midlife MOTs, which provide support and information to people in the middle of their working life to help them plan more holistically for their future work, wealth and wellbeing.

We also want to boost engagement overall, so we’ve confirmed plans to create a commercial pensions dashboard to help our customers achieve greater awareness of their retirement savings and a holistic view of their finances.

It’s concerning to see that women are still consistently less optimistic and confident about their financial situation than men. So we must continue to tailor the support we offer to help them engage more with their financial planning.

-

Encourage people to plan and use free guidance

Since the cost-of-living crisis, financial planning arguably has an even more critical role to play in helping people manage not just their financial pressures, but also the potential adverse mental and physical effects of financial worry.

So we need to do even more to give people the tools to plan for their retirement, while promoting the benefits of seeking guidance or advice. Ultimately, however, we must make support available to whoever needs it most. And this has to come in a form that’s personal, relatable and engaging. Only then can we hope to foster better financial and social wellbeing for all.

Get the full report

To dive deeper into our research, download our Retirement Voice 2023 report.

1Between July and September 2023, Standard Life commissioned an independent study that sought to understand consumer attitudes to pensions and retirement plans. The study questioned a total of 6,350 UK adults, with the data weighted to give a nationally representative sample by age, gender, region and working status. The research sample included UK adults aged 18–80 and covered a range by income, savings, region, gender, ethnicity, and other key attributes.