id

- 172% increase in searches for the best savings account in July compared to the same time last year – increase follows an 82% uptick in June

- Anxious borrowers record 7,000 searches asking when will mortgage rates drop in both June and July

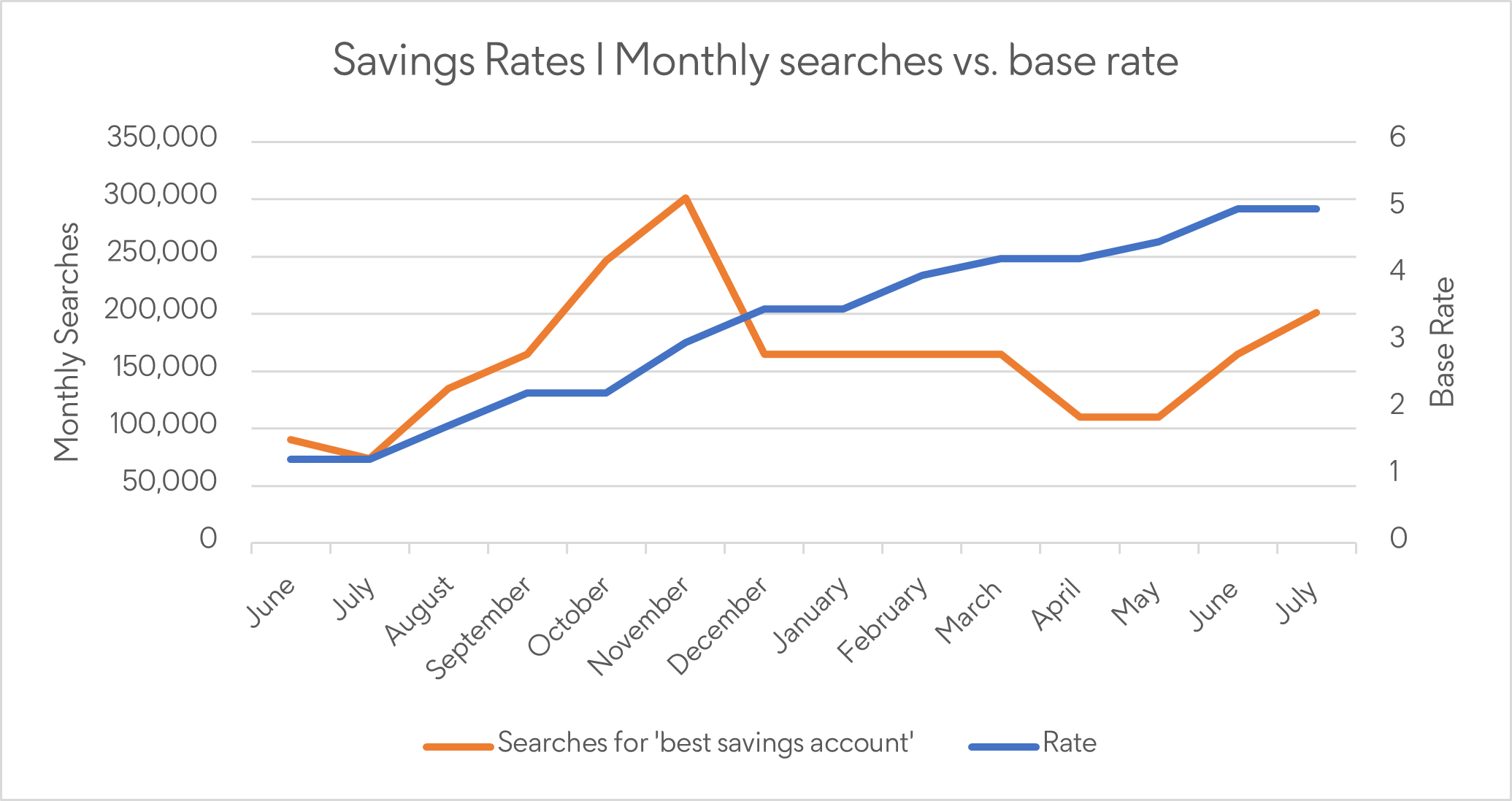

Online searches for ‘best saving account’ jumped 82% in June and 172% in July compared to the same time last year. This equated to around 165,000 searches in June and 201,000 in July as thousands of additional savers went on the hunt for better rates according to new analysis of search engine data from Standard Life, part of Phoenix Group.

Savers search for best buys in second wave of deal hunting

A series of rate increases in the last twelve months also drove over 74,000 searches for ‘best savings rate’ in June and a further 90,500 in July. The recent uptick follows an initial spike in searches linked to savings rates in November last year which followed a period in which interest rates more than doubled between June and November 2022.

The recent search trend was replicated over a variety of terms associated with savers on the hunt for better rates. For example, there were around 18,000 searches for ‘best 1 year fixed rate ISA’ in June which increased to just over 22,000 in July – equivalent to annual increases of 235% and 311% respectively. Not only do those with cash savings have scope to generate higher returns but recent falls in inflation mean the gap between interest rates and inflation is now relatively modest on certain types of savings account.

Borrowers hope rates have peaked

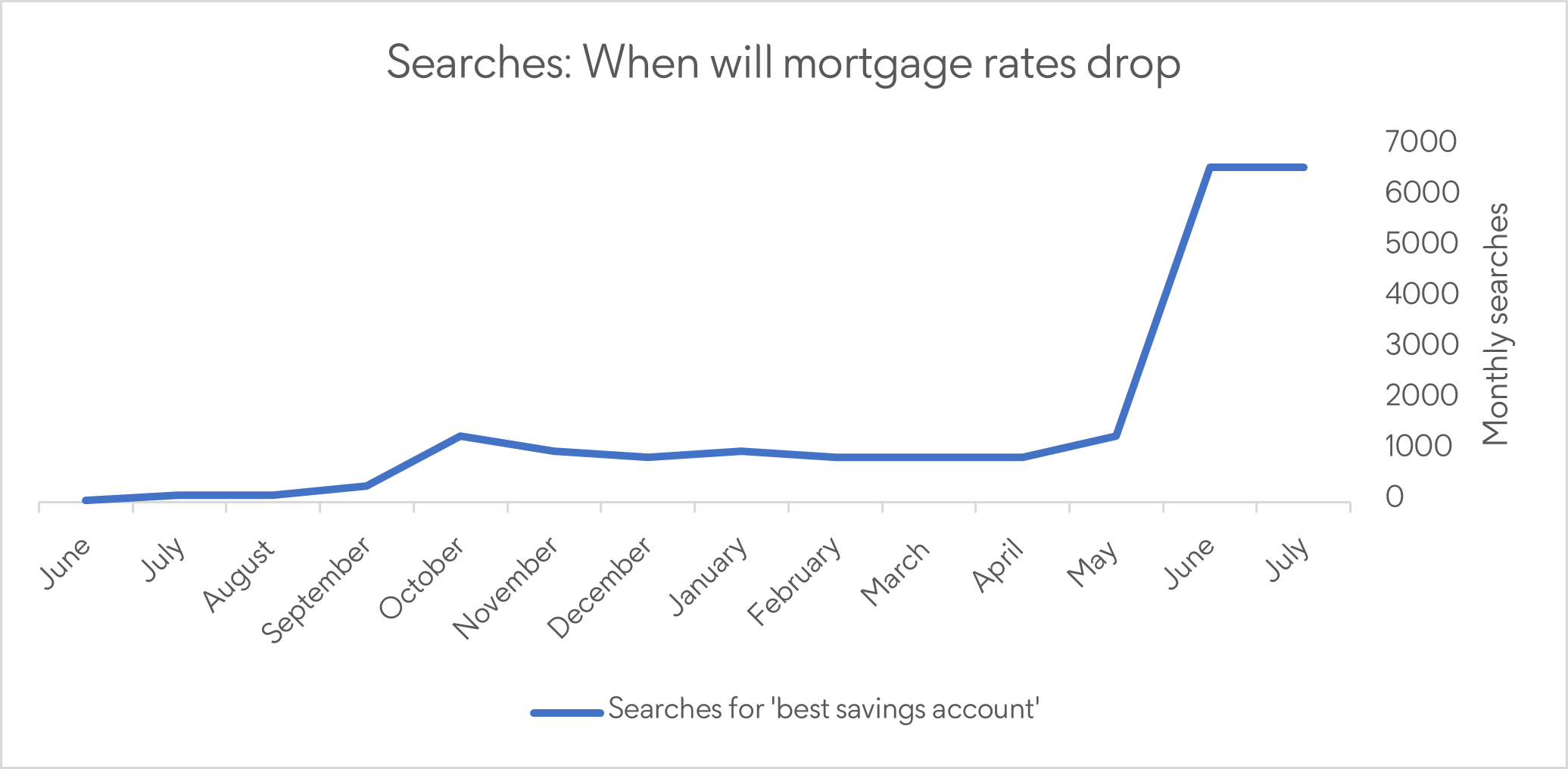

There was a corresponding increase in people seeking information on when mortgage rates may fall. Searches for the term ‘when will mortgage rates drop’ jumped from next to nothing twelve months ago to nearly 7,000 in June and July.

Dean Butler, Managing Director for Retail at Standard Life, comments: “Over the last decade returns on cash savings have been meagre. However, eight rate rises in the last twelve months have prompted those with cash to look again at what’s on offer and the search data suggests people are shopping around. There’s a catch however as higher returns have been accompanied by even higher inflation and although the gap between the two is closing, those with excess savings will want to consider investing some of their money through their pension or investment ISA as it offers the potential to generate real returns.

“While it’s good news for savers, the search data paints a different picture for borrowers and there’s evidence that mortgage holders are looking for insight on whether rates have peaked. This is an anxious time for those coming to the end of fixed rate deals many of whom will be weighing up whether to refix their mortgage or hold off to see whether rates come down at all.”

-Ends-

Enquiries

James Ikin

Lansons

07519 556776

jamesi@lansons.com

James Merrick

Standard Life, part of Phoenix Group

07974 063067

james_merrick@standardlife.com

About Standard Life

- Standard Life is a brand that has been trusted to look after peoples’ life savings for nearly 200 years.

- Today it proudly serves millions of customers who come to Standard Life directly, through advisers and through their employers’ pension scheme.

- Standard Life is part of Phoenix Group, the largest long-term savings and retirement business in the UK. We’re proud to be building on nearly 200 years of Standard Life heritage together.

- Our products include a variety of Pensions, Bonds and Retirement options to suit people’s needs, helping our customers to invest and save for their future. We’re proud to offer a leading range of sustainable and responsible investment options.

- We support our customers on their journey to and through retirement with comprehensive, easy-to-understand guidance so they can invest in the right way for their needs and plan a future they feel confident about.

- Standard Life is the proud headline sponsor of Race for Life, Cancer Research UK’s flagship fundraising event series.

- The value of investments can go down as well as up and may be worth less than originally invested.

Press releases

-

February 09, 2026

Standard Life completes £700m Bulk Purchase Annuity with the Deloitte UK defined benefit pension scheme

Standard Life has concluded a £700 million Bulk Purchase Annuity (BPA) transaction with the Deloitte UK pension scheme (DUKPS, or ‘the Scheme’) section of the Pensions Master Plan, securing the benefits of all pensioner and deferred members of the legacy defined benefit scheme.

-

February 04, 2026

Living with uncertainty: with 83% of UK adults feeling the world has become less predictable, many are reassessing their financial future

The year may have only just begun, but for many people it already feels a lot to take in. From global tensions to the ongoing squeeze on household budgets, it’s no wonder confidence feels fragile - and new research from Standard Life’s Retirement Voice report highlights just how widespread that feeling has become.

-

February 03, 2026

Standard Life revamps Onshore Bond and re-enters market in anticipation of tax rule changes

Standard Life has re-entered the Onshore investment bond market with the relaunch of its Tailored Investment Bond adding a range of fully modernised features that meet the evolving tax planning needs of advisers and clients.

-

February 02, 2026

Communication through buy-out process a critical enabler of a smooth transition – new DB member research

Confidence among defined benefit (DB) pension members is high, with 86% saying they feel confident about their pension, and trust it is secure, understand how it works and expect it to deliver without surprises. This is largely due to trust in the system and broad understanding about their pension, according to Standard Life’s new DB Member Insights Report 2026.

-

January 29, 2026

New Research Reveals Emotional Rollercoaster Behind Retirement Decisions

New qualitative study explores psychological biases, decision-making processes, and lived experiences during the transition from saving to spending in retirement.

-

January 29, 2026

Do we really want to #bringback2016? Only one in six prioritised pensions, and now more than a third wish they had

Just one in six (16%) say pensions were a key financial priority in 2016, while more than a third (36%) now wish they’d contributed more over the last ten years – almost half (45%) of Millennials admit pension regret.

-

January 28, 2026

Boost for retirees as annuity rates climb to 7.51% at end of 2025

Annuity rates continued their upward trend at the end of 2025, rising to 7.51% for a healthy 65-year-old, a 5.48% increase on the December 2024 rate of 7.12%, according to the Standard Life Annuity Rates Tracker.

-

January 26, 2026

As Gold hits a fresh all-time high: does it have a place in my pension?

Standard Life explores some of the pros and cons of holding Gold in your pension.

-

January 20, 2026

Emergency savings gap: one in five Brits would need to borrow to cover a £250 bill

One in five UK adults (21%) say they would need to take on debt to cover an unexpected £250 bill, and a further 5% say they wouldn’t be able to fund such a cost at all, according to new research from Standard Life’s latest Retirement Voice report.

-

January 16, 2026

Standard Life appoints Neil Jones to strengthen technical wealth planning support for advisers

Standard Life has enhanced its technical wealth planning support for advisers with the appointment of Neil Jones, tax and estate planning specialist.

-

January 15, 2026

Two weeks until the self-assessment tax return deadline - watch out for the child benefit trap, and your pension

Self-employed and higher earners need to submit their return online by 31st January.

-

January 14, 2026

Feeling the pinch of ‘friendflation’ this January? Halving your socialising spend could add £173k to your retirement pot

After the festive season splurge, January often brings a financial reality check.

-

January 07, 2026

Outlook for the BPA market in 2026

Market expected to exceed £50 billion in 2026

-

January 06, 2026

Cancelling unwanted direct debits could boost your pension by £37k

With the New Year a time for a fresh start, analysis highlights how cutting out wasted direct debits could boost your retirement pot by £37k

-

December 18, 2025

Standard Life completes £525m full buy-in for Skanska Pension Fund, advised by LCP

The Trustee of the Skanska Pension Fund (“the Fund”), working closely with its corporate sponsor Skanska plc and parent company Skanska AB, has purchased a £525m full buy-in covering all of its c.7,000 members, with Standard Life.

-

December 17, 2025

‘Tis the season… to avoid talking about money: millions still dodge pension conversations

Just a third (33%) have spoken to their family about pensions in the last year.

-

December 15, 2025

Planning assumptions being turned on their head as concerned clients seek reassurance over IHT changes

Over three-quarters (77%) of advisers expect an increase in workload due to pensions IHT change in April 2027.

-

December 11, 2025

Generations divided over Autumn Budget as salary sacrifice changes add to anxiety

New Standard Life research exposes generational divide and mounting concern over future pension affordability.

-

December 09, 2025

A Christmas gift that keeps on giving: investing £600 per year could give your child a £34,000 retirement boost

New Standard Life analysis reveals how redirecting even a small portion of festive spending into a child’s pension could deliver benefits that last far beyond this Christmas

-

November 25, 2025

Angela Byrne appointed CEO of Pensions & Savings at Standard Life

Pensions & Savings is a strategic focus for the Group and manages c.£190bn of customers’ savings across three key trading channels

-

November 24, 2025

DB Endgame planning gains pace – but market volatility and illiquid assets remain key challenges for a third of trustees

Trustees of UK defined benefit (DB) pension schemes pursuing a buy-in or buy-out strategy are making steady progress towards their endgame goals, with close to one fifth of schemes reporting no barriers to executing their plans.

-

November 13, 2025

Standard Life launches Flexible Reversionary Plan

New Trust adds increased financial flexibility to Standard Life’s tax-efficient client solutions

-

November 11, 2025

Bought your first home? Keep the savings habit going for a huge retirement boost

Continuing to save at the maximum Lifetime ISA (LISA) rate could lead to £204,000 more in retirement

-

November 10, 2025

Standard Life Centre for the Future of Retirement gears up for a new initiative to inspire and empower those at mid-career crossroads

The Standard Life Centre for the Future of Retirement and Careers can change campaign are gearing up for Re:Work Live, their biggest ever event on 14th November. The event brings together an inspiring mixture of career change experts and specialists in the skills, mindset and financial aspects of career change

-

November 05, 2025

Sun over security: Brits twice as likely to save for a holiday as for their pension

As cost-of living pressures continue, UK adults prioritise short-term enjoyment over long-term financial security

-

November 04, 2025

DB trustees divided on surplus reform as buy-out certainty gains appeal

Nearly two fifths (39%) of defined benefit (DB) trustees are uncomfortable that proposed surplus reforms are in scheme members’ best interests. New research from Standard Life highlights a growing divide among trustees with significant concern from some surrounding the impact of surplus reforms on member outcomes and long-term scheme strategy.

-

October 31, 2025

Annuity payback period drops to just 13 years, as rates rise nearly 10% since 2024

The Standard Life Annuity Rates Tracker reveals that average annuity rates reached 7.65% in September 2025, a year-on-year increase of nearly 10%

-

October 29, 2025

Millions risk missing out on retirement income by losing track of their savings

Standard Life research finds less than a third of UK adults have kept track of all their pension pots

-

October 24, 2025

Third State Pension Age Review: independent Call for Evidence

Catherine Foot, Director of the Standard Life Centre for the Future of Retirement, comments on the Third State Pension Age Review: independent Call for Evidence which closes for submissions today

-

October 22, 2025

Only half of Brits believe the State Pension will exist for everyone by the time they retire

Standard Life's Retirement Voice 2025 report finds people lack confidence in the future of the State Pension

-

October 15, 2025

Gen Z dream of retiring at 60 - but only one in ten prioritise pensions and 59% believe auto-enrolment contributions will be enough to fund their retirement

Standard Life's Retirement Voice 2025 report highlights Gen Z's retirement opportunities and risks

-

October 09, 2025

Momentum in the BPA market continues with 40% of schemes planning to approach an insurer in the next 12 months

The current push for buy-ins activity looks set to continue with 40% of defined benefit trustees targeting BPA as their end-game strategy expecting to approach an insurer in the next 12 months.

-

October 07, 2025

Standard Life launches 2025 Retirement Voice report revealing widening gap between retirement hopes and expectations

The newly published Retirement Voice report from the Standard Life Centre for the Future of Retirement highlights a growing five-year gap between when UK adults hope to retire and when they expect to be able to, driven by financial pressures, pension insecurity, and regional disparities.

-

October 06, 2025

Standard Life launches affordable pension advice business

Standard Life Financial Advice aims to support those who would not usually seek or receive financial advice

-

October 02, 2025

How Gen Z savers could boost their pension by tens of thousands

Standard Life analysis shows how young workers could bolster their savings for the price of a TV subscription

-

September 25, 2025

Standard Life completes £52 million full buy-in with The Amtico Company Pension Scheme

Standard Life, part of Phoenix Group, has successfully completed a £52 million Bulk Purchase Annuity (BPA) transaction with The Amtico Company Pension Scheme.

-

September 24, 2025

Scots top Great Britain in viewing Power of Attorney as important

Scotland leads Great Britain in Power of Attorney awareness and uptake – but knowledge gap could leave many at risk

-

September 24, 2025

Standard Life to launch next generation private markets default strategy

Standard Life is preparing to launch a new alternative pension default fund underpinned by a significant allocation to private assets.

-

September 18, 2025

Almost half of UK adults don’t know how much is in their pension

This Pension Engagement Season is a timely reminder to check in on your pension – especially as new research¹ from Standard Life reveals that nearly half of UK adults (47%) can’t put a figure on how much they have in their pension savings.

-

September 10, 2025

A third of UK adults have voluntarily increased pension contributions – and even small top-ups could add thousands to retirement savings

New research from Standard Life reveals that nearly a third of UK adults are increasing their workplace pension contributions beyond the minimum level

-

September 09, 2025

How to avoid outliving your pension in retirement?

Standard Life analysis reveals impact of different withdrawal and investment scenarios.

-

September 03, 2025

Standard Life appoints Claire Altman

Standard Life appoints Claire Altman to drive growth in Defined Benefit and Individual Retirement markets

-

September 02, 2025

The cost of renting in retirement rises to £398k

People who expect to rent during retirement could need an additional £398,000 in savings compared to those with no housing cost.

-

August 22, 2025

Pension vs Property

Pension vs Property? Younger generations bet on both for retirement security

-

August 14, 2025

More than a third of over-55s would consider quitting their jobs over lack of flexible working

More than a third of over-55s would consider quitting their jobs over lack of flexible working

-

August 13, 2025

Want to make your summer holiday permanent? Don’t forget about your pension

Standard Life answers key pension questions for those looking for something more long-lasting

-

August 06, 2025

Standard Life completes £1.9bn bulk purchase annuity transaction

Standard Life completes £1.9bn bulk purchase annuity transaction with the Sedgwick Section of the MMC UK Pension Fund

-

August 05, 2025

Employed to self employed

With self-employment on the rise, Standard Life shares important tips to help keep your pension on track if you’re becoming your own boss.

-

July 30, 2025

Moving jobs? Don’t leave your pension in the past

Standard Life shares the key pension considerations to bear in mind when leaving a company

-

July 28, 2025

Consider your savings when taking a career break

The return of Oasis has shown us the power of taking a break - but there could be long-term financial implications of time out

-

July 28, 2025

Keep your cool, and your cash

Simple steps to avoid feeling the financial heat this summer

-

July 17, 2025

The price of advice: Power to boost savings by £40k or more, and raise levels of financial confidence

New research from Standard Life’s Retirement Voice report reveals the significant impact financial advice can have on people’s finances and their financial wellbeing, with almost two in five (37%) advised individuals estimating they are £40,000 or more better off thanks to professional financial support.

-

July 14, 2025

When I’m 64 – age revealed as the most common point to buy an annuity as retirees look to bridge the gap to state pension

Sales data from Standard Life, part of Phoenix Groups shows that 64 is the average age at which people purchase lifetime annuities, while it’s 63 for fixed term annuities.

-

July 09, 2025

Savers resoundingly back concept of Targeted Support but identify practical design challenges that must be overcome

Unique qualitative study delves into consumer attitudes and expectations of the FCA’s proposed Targeted Support (TS) service in the context of retirement income decision making and finds

-

July 08, 2025

Counting your chickens? One in four Gen Z neglect retirement savings, betting on an inheritance instead

A quarter of Gen Z (24%) say they’re not prioritising saving for retirement, expecting an inheritance to fund their later life

-

July 01, 2025

Fair play off the pitch? As the Women’s Euros begins, football’s pay gap shows an extreme version of broader pay and pensions inequality

As the UEFA Women’s Euro 2025 kicks off in Switzerland, all eyes will be on the talent and determination of the 16 competing national teams. But while the football should be fair on the pitch, what happens off it is far less equal.

-

June 26, 2025

Annuity rates surge above 7.7% - highest point of the decade

Annuity rates rebounded from their lowest levels, previously seen in 2020, and have reached 7.72% for a healthy 65-year-old, according to the Standard Life Annuity Rates Tracker.

-

June 24, 2025

Standard Life analysis highlights the power of saving early

Postponing pension saving by 5 years in your twenties can result in tens of thousands less in retirement

-

June 20, 2025

£31bn Growth Threat: Over 50s workforce exit risks putting the brakes on growth

With growth at the heart of the government’s agenda and the UK’s Industrial Strategy expected imminently, new analysis reveals that early workforce exits among over-50s as a key risk which are costing the economy an estimated £31 billion each year.

-

June 20, 2025

Risk appetite is key when planning for retirement

Three-quarters of over 50’s say risk appetite is key when planning for retirement and two fifths expect their tolerance to reduce with age

-

June 20, 2025

Considering job polygamy? There are potential retirement pros and cons

Standard Life finds a potential £47k pension boost of holding multiple jobs - if you can avoid burnout

-

June 17, 2025

Phoenix Insights rebrands as the Standard Life Centre for the Future of Retirement

Phoenix Group’s think tank, Phoenix Insights, has rebranded under Standard Life as part of the think tank’s bold ambition to help everyone achieve long-term financial security.

-

June 10, 2025

Finance for all the family

Standard Life, part of Phoenix Group, has launched Family Finance Hub, a new digital coaching platform designed to help families navigate key financial moments with confidence and clarity

-

May 27, 2025

A guessing game

1 in 6 UK adults relying on gut instinct to estimate retirement needs

-

May 19, 2025

Britain’s biggest pension taxpayers

Britain’s biggest pension taxpayers – and how to protect your retirement savings from the tax man

-

May 13, 2025

Standard Life celebrates one year anniversary of its Trustee Accelerator Programme

Plans are in place to extend innovative Programme across the industry

-

May 09, 2025

Standard Life research highlights the cost of being single in retirement

Single pensioners need £255,000 more in their pension pot to achieve a moderate standard of living than pensioner couples

-

May 08, 2025

Standard Life completes £280m buy-in with the Cancer Research UK Pension Scheme

Standard Life, part of Phoenix Group, has successfully concluded a £280m Bulk Purchase Annuity transaction with the Cancer Research UK Pension Scheme.

-

May 02, 2025

Standard Life completes connection to the pension dashboard ecosystem

Connection is in line with the Department of Work and Pensions guidance timetable

-

April 30, 2025

400 UK children have more than £100,000 in their Junior ISA, while a child pension could lead to a later-life boost

Standard Life's Freedom of Information request reveals number of large JISAs

-

April 29, 2025

Standard Life completes Sustainability Disclosure labelling implementation

Standard Life completes Sustainability Disclosure

labelling implementation, investing close to £30 billion via sustainable solutions -

April 29, 2025

Understanding of annuities improves by 25% in the last year

Understanding of annuities improves by 25% in the last year, but common misconceptions still remain

-

April 22, 2025

Locked in to corporate life

How attitudes to work could shape people's long-term savings

-

April 17, 2025

Half of UK adults unsure how much they'll receive in their state pension

As confusion abounds, Standard Life answers key state pension questions

-

April 08, 2025

New Tax Year, New You? How to make your allowances count

Standard Life, part of Phoenix Group, shares key financial tips for the start of the tax year

-

April 03, 2025

The Price of Freedom? While most value Pensions Freedoms, many worry about their long-term financial security

New research from Standard Life, finds that while the vast majority (79%) value the choice and control the legislation provides, some who have accessed their pension funds have concerns about the long-term impact.

-

April 01, 2025

The most favoured options for Trustees managing illiquid assets as part of BPA transactions

Research from Standard Life reveals that DB Trustees are considering a range of strategies to manage their illiquid holdings as they seek to meet the necessary liquidity requirements needed to secure their endgame strategy.

-

March 26, 2025

'As you were' after the Spring Statement – what next for pensions?

Mike Ambery, Retirement Savings Director at Standard Life, comments on the Spring Statement

-

March 25, 2025

Caravan and Motorhome Club hitches pension arrangements to Standard Life

Over 1100 members successfully transition to Standard Life contract based GFRP arrangement

-

March 19, 2025

Standard Life and Fidelity International build on strategic partnership

Standard Life and Fidelity International build on strategic partnership with launch of Guaranteed Lifetime Income plan

-

March 13, 2025

Average annuity rates increase March

Average annuity rates increase by around 8% in twelve months

-

March 12, 2025

Standard Life's pension-finding tool reunites customers with £50 million of lost savings in just five months

The tool, powered by Raindrop, has empowered almost 3,000 Standard Life customers to take control of their retirement savings

-

March 12, 2025

Ten years on: The ongoing impact of Pensions Freedoms | Standard Life

New research from Standard Life, part of Phoenix Group reveals that the vast majority of those who have accessed their pension savings view the reforms positively

-

March 11, 2025

Autumn budget aftermath

Autumn budget aftermath: Two thirds of IFAs recommend clients increase the retirement income they take, and three quarters re-evaluate the role of annuities

-

March 11, 2025

Meeting your younger self for coffee

You might want to discuss your retirement savings

-

March 11, 2025

Mixed Income Builder

Standard Life develops Mixed Income Builder, giving savers a simple protect and flex approach to understanding their retirement income

-

February 27, 2025

Preparedness for buy-in or buy-out remains key barrier to endgame for DB Scheme Trustees

Preparedness for buy-in or buy-out remains key barrier to endgame for DB Scheme Trustees – but majority are seeking advice to improve data and process

-

February 27, 2025

Standard Life focuses on Offshore Bond

Standard Life continues to grow its Offshore Bond business securing three new platform panel positions for its International Bond.

-

February 12, 2025

Standard Life completes £250m buy-in with the Finning Pension Scheme

Standard Life, part of Phoenix Group, has successfully concluded a £250m Bulk Purchase Annuity transaction with the Finning Pension Scheme, which is sponsored by Finning (UK) Ltd., a Caterpillar machinery dealership. This full scheme buy-in transaction, which completed in December 2024, covers all c. 2,170 members of the Scheme.

-

February 06, 2025

Annuitising in phases

Combining drawdown and phased annuitising provides a way for both.

-

February 05, 2025

Cancelling unwanted direct debits could boost your pension pot

Standard Life analysis finds a potential £37,000 retirement benefit to scrapping wasted monthly payments

-

February 04, 2025

New Independence Governance Committee appointment

Standard Life bolsters Independence Governance Committee with Barry Butler appointment

-

January 28, 2025

The Great Unretirement

Standard Life analysis finds one in seven retirees returning to work

-

January 23, 2025

Gen Z turn to social media to save for the future

As the TikTok US ban debate rages on, Standard Life research uncovers its retirement planning potential.

-

January 20, 2025

The long and winding road

The study examined how Standard Life customer’s financial priorities shift as they move through life, with each lifestage characterised by their own pressing issues.

-

January 13, 2025

Ready for (Micro) Retirement?

Returning refreshed and working for longer as a result of a year out could lead to a 42k retirement boost

-

January 10, 2025

New Year divorce spike - remember your pension

This year, bear in mind upcoming Inheritance Tax changes

-

January 09, 2025

Standard Life completes £1.5bn Plan buy-in with the Compass Group Pension Plan

Standard Life, part of Phoenix Group, has successfully concluded a £1.5bn Bulk Purchase Annuity (“BPA”) transaction with the Compass Group Pension Plan (the “Plan”). The sponsoring employer, Compass Group PLC (the “Company”), is a global leader in food services.

-

December 18, 2024

Pensions for children: a present that isn’t just for Christmas

Standard Life outlines how at Christmas parents could help give them a head start on saving for later in life

-

December 11, 2024

Kunal Sood comments on key trends for the DB de-risking market in 2025

Kunal Sood, Managing Director of Defined Benefit Solutions comments on key trends for the DB de-risking market in 2025

-

December 10, 2024

One in four over 55's have never checked their pension

With many at risk of losing out in retirement, Standard Life shares tips on when and how to check your pot

-

December 09, 2024

MPAA and lifetime annuities

Annuities offer a perk for older workers looking to access their retirement savings while continuing to top up their pension

-

November 19, 2024

After the Budget: UK savers react to pension inheritance changes

After the Budget: UK savers react to pension inheritance changes

-

November 19, 2024

Standard Life Leads Pensions Industry by Investing in Labelled Funds under SDR Regime

Standard Life believed to be the first pension provider to proactively align to the FCA’s new Sustainability Disclosure Requirements (SDR) and fund labelling rules for its primary default pension solution

-

November 18, 2024

Bridging the income gap

Ability to bridge the income gap between early retirement and state pension age is important

-

November 18, 2024

Standard Life bolsters Defined Benefits Solutions team with senior hire

Standard Life, part of Phoenix Group, today announces the appointment of Alexa Mitterhuber

-

November 11, 2024

The other millennium bug: Gen X apprehensive after slipping between DB and DC cracks

Standard Life's Retirement Voice 2024 research highlights the Gen X savings gap

-

November 07, 2024

Standard Life completes £250m of buy-ins with the Halma Group Pension Plan and the Apollo Pension and Life Assurance Plan

Bulk Purchase Annuity secures the benefits of 2,200 members

-

November 05, 2024

Two incomes and no children? Consider your pension

Standard Life analysis shows how DINKs could boost their long-term savings

-

October 29, 2024

Universities Superannuation Scheme (USS) supports Standard Life’s Trustee Accelerator Programme

Trustee Trainee, Dean Dennis to shadow USS Pensions Committee

-

October 24, 2024

Average annuity rates increased by 2.5% since January 2024 and remain steady throughout 2024

Annuity rates have increased by 2.5% since January 2024 for a healthy 65-year-old, according to the Standard Life Annuity Rates Tracker1. This has added £3,360 and £3,720 to the total lifetime income expected for a 65-year-old man and woman respectively.

-

October 23, 2024

Standard Life analysis highlights the value of the triple lock

Pensioners over £1,100 better off than if the state pension rose by inflation alone

-

October 23, 2024

The outlook for the BPA market for the rest of 2024

Standard Life, part of Phoenix Group, comments on the outlook for the BPA market for the rest of 2024

-

October 17, 2024

Don't forget your pension when considering a job offer

Standard Life highlights the benefit of a generous workplace pension package

-

October 10, 2024

Standard Life appoints Andrew Davies to Chair Independent Governance Committee

Appointment maintains strong links between Standard Life’s IGC and the Master Trust Board

-

October 08, 2024

University - and your retirement

Standard Life highlights the trade-off involved when taking out a student loan

-

October 03, 2024

Half of over 55s never talk to loved ones about retirement goals or finances

Standard Life highlights the benefits of talking about your retirement goals with loved ones

-

October 01, 2024

Standard Life launch new free to all pension service

Powered by Raindrop, the tool will help people find their lost pensions

-

September 25, 2024

Overtime pay could boost your retirement

Standard Life highlights the £125k benefit of putting overtime pay in your pension.

-

September 09, 2024

Standard Life launches new Guaranteed Fixed-term Income product

Standard Life, part of Phoenix Group, today announces the launch of Standard Life Guaranteed Fixed-term Income

-

August 29, 2024

Standard Life appointed as ‘safe haven’ provider for scammed pension savers

Standard Life appointed as ‘safe haven’ provider for thousands of scammed pension savers

-

August 21, 2024

Delaying pension saving by 5 years can lead to 50k less in retirement

Standard Life analysis highlights the cost of neglecting your pension in your twenties

-

August 21, 2024

The outlook for the BPA market for the rest of 2024

Standard Life, part of Phoenix Group, comments on the outlook for the BPA market for the rest of 2024

-

July 29, 2024

Lifetime annuity rates rise to over 7% in June

Lifetime annuity rates rise to over 7% in June, following steady increase since the start 2024

-

July 25, 2024

Standard Life completes £100m buy-in with a group of pension schemes operating in the travel catering industry

Bulk Purchase Annuity secures the benefits of c. 2,100 members

-

July 24, 2024

Phased retirement could boost your pension pot

Standard Life analysis shows the potential benefit of winding down work before stopping completely

-

July 17, 2024

What the King's Speech could mean for your pension

Standard Life picks out the notable pension developments

-

July 03, 2024

Moving abroad? Remember your pension

Standard Life answers key pensions questions for those moving away from the UK

-

July 02, 2024

How to buy more days of retirement

Boosting contributions can increase your options

-

June 27, 2024

Standard Life completes £880m buy-in with the Rolls-Royce & Bentley Pension Fund

Standard Life, part of Phoenix Group, has concluded a £880 million Bulk Purchase Annuity (“BPA”) transaction with the Rolls-Royce & Bentley Pension Fund (“the Scheme”), which is sponsored by Bentley Motors Limited. This is a full scheme buy-in transaction covering c. 6,000 members of the Scheme

-

June 25, 2024

The cost of renting in retirement: £391k

People who expect to rent throughout their retirement could need an additional £391,0002 in savings compared to those who have paid off their mortgage, according to new analysis from Standard Life, part of Phoenix Group

-

June 19, 2024

Standard Life Master Trust secures £10bn in assets under administration

Assets have doubled in value over the last three years

-

June 12, 2024

Conversations with Friends: Two-thirds of Generation Z happy to discuss money with friends

Being open about finances could pay off in future

-

June 03, 2024

Britain's biggest pension taxpayers

And how to avoid becoming one

-

May 29, 2024

Income withdrawal strategy tops list of adviser's Retirement Income Review focus areas

Suitability and cash flow modelling follow closely behind

-

May 22, 2024

One in seven retirees receive less state pension than expected

Standard Life analysis highlights the state pension knowledge gap

-

May 15, 2024

Standard Life urges industry collaboration on vulnerable customer support

This Mental Health Awareness Week, Standard Life and Phoenix Group call for a coalition of the willing and determined

-

May 08, 2024

Tempted by a ‘lazy job’?

It could cost you in retirement

-

May 07, 2024

Siemens appoints Standard Life as its new Master Trust provider

Over 30,000 Siemens members move to Standard Life Master Trust

-

May 01, 2024

Helen Dean begins tenure as Standard Life Master Trust Chair

Helen will oversee the interests of more than 300,000 Master Trust scheme members

-

April 25, 2024

Cost of being single in retirement

Standard Life analysis finds single pensioners need to save more than pensioner couples for the same standard of living

-

April 23, 2024

Standard Life announces four key appointments within its Defined Benefit Solutions team

The moves reflects the growing pool of talent and expertise available within Standard Life’s Defined Benefit Solutions team

-

April 23, 2024

Standard Life Launches Trustee Accelerator Programme

Twelve trainee trustees embark on two year programme

-

April 11, 2024

Retirees £119,000 worse off than they'd hoped

Standard Life research highlights the pension reality gap

-

April 09, 2024

New tax year, new you

Standard Life shares tips on how to maximise pension savings in the 2024-25 tax year

-

April 08, 2024

Check your eligibility as most state benefits rise

Key benefits including Universal Credit are rising - make sure you don't miss out

-

March 27, 2024

Phoenix Group publishes 2023 financial results

Andy Curran, CEO of Standard Life comments as parent, Phoenix Group, publishes 2023 financial results

-

March 26, 2024

Week 13 of the year is top for top ups

Standard Life analysis shows a pre- Tax Year End rush

-

March 19, 2024

A fifth of over 50s rely on Defined Benefit

A fifth of over 50s rely on Defined Benefit (DB) pensions providing almost half of their retirement income but numbers set to fall, reveals Standard Life’s Retirement Income Almanac

-

March 19, 2024

Average annuity rates increase by 6.8% in the last twelve months

Annuity rates have increased by 6.8% since February 2023 for a healthy 65-year-old, according to the Standard Life Annuity Rates Tracker. This has added £9,430 and £9,750 to the total lifetime income expected for a 65-year-old man and woman respectively.

-

March 14, 2024

It's 10 years since the announcement of Pension Freedoms

A decade on, people like choice but confusion abounds

-

March 12, 2024

14% of retirees have returned to work

Standard Life analysis highlights the cost of retiring crisis

-

March 04, 2024

Standard Life's Sustainable Multi Asset turns three

At the third anniversary, assets under management reaches c£24 billion

-

February 27, 2024

Not used up your pension allowances

It's not the 'Tax Year End' of the world

-

February 26, 2024

Standard Life and Fidelity International announce strategic partnership with the launch of a new Smoothed Fund

Standard Life and Fidelity International announce strategic partnership with the launch of a new Smoothed Fund

-

February 22, 2024

Standard Life appoints Mike Ambery as Retirement Savings Director

Standard Life, part of Phoenix Group, has appointed Mike Ambery in the new role of Retirement Savings Director.

-

February 15, 2024

Standard Life completes £114m buy-in with the Vector Pension Scheme

Standard Life, part of Phoenix Group, has concluded a £114 million Bulk Purchase Annuity transaction covering c. 1,800 members of the Vector Pension Scheme

-

February 14, 2024

Why you should use your bonus to boost your pension

Standard Life analysis shows the benefits of extra one-off pension contributions

-

February 13, 2024

Show your pension some love this Valentine's Day

Standard Life shows how small things can make all the difference

-

February 05, 2024

Gen X far more uncertain on when to retire than older generations

31% of Gen X are uncertain about when to retire, versus 19% of Baby Boomers and older generations

-

January 29, 2024

Young Brits expect property to fund retirement

Standard Life finds Gen Z relying on property rather than pensions

-

January 24, 2024

Standard Life completes £300 million full scheme buy-ins

Standard Life completed a £300 million full scheme buy-ins with the iPSL Section of the Unisys Payment Services Limited Pension Scheme and the Unisys Public Sector Pension Scheme in 2023.

-

January 24, 2024

Standard Life comments on the closure of the DWP's 'pot for life' consultation

Standard Life comments on closure of the Government's 'pot for life' consultation

-

January 18, 2024

Only a third of UK adults feel confident about tax self-assessment

Hints and tips as the 31st January deadline approaches.

-

January 16, 2024

Financial planning high up young people's agenda

Standard Life research shows how the cost of living crisis has raised financial awareness

-

January 16, 2024

Economic environment prompts young Brits to prioritise planning

Standard Life analysis finds inflation and interest rates are bringing finances up young people's agenda

-

January 15, 2024

Rounding up your pension contributions could boost your retirement pot

Standard Life analysis finds rounding your contributions to the nearest £100 could generate thousands more in retirement savings.

-

January 11, 2024

What you need to know about divorce and pensions

Standard Life provides some key facts during the January divorce spike

-

December 21, 2023

Standard Life’s December Search Radar

Latest internet search trend analysis finds spikes in searches for best buy savings accounts, pensions and Pension Credit

-

December 20, 2023

Get your finances fighting fit for 2024

Standard Life shares tips for financial success in the new year

-

December 19, 2023

Almost half of over 50s lack awareness on wide range of annuities available

Almost half (45%) of over 50’s admit they don’t know that annuities come in many forms and with various options, according to new research from Standard Life, part of Phoenix Group, which explores awareness and levels of knowledge amongst the over 50’s around annuities

-

December 19, 2023

One in five face sleepless nights worrying about retirement

Standard Life research highlights the need for support with later life planning

-

December 12, 2023

Lack of State Pension knowledge could hinder pension planning

State Pension uncertainty confuses retirement preparation, but checking entitlement is straightforward

-

December 11, 2023

Kunal Sood, Managing Director of Defined Benefit Solutions and Reinsurance comments on DB outlook for 2024

Standard Life comments on the key trends for the DB de-risking market in 2024

-

December 08, 2023

A quarter of over 50s incorrectly think that annuities give the best rates to people without underlying health conditions

A quarter (25%) of over 50-year-olds incorrectly think that annuities give people without underlying health conditions the best rates, according to research from Standard Life, part of Phoenix Group

-

December 07, 2023

23% of young adults have never heard of auto-enrolment

Youngsters set to benefit from new pension saving rules despite lack of awareness

-

November 29, 2023

Standard Life support Samaritans to help those struggling this Christmas

Standard Life funding to help Samaritans continue answering calls this Christmas Day

-

November 28, 2023

Standard Life Master Trust Board Appointments

Standard Life Appoints Helen Dean to Chair Master Trust Board and Gurmukh Hayre as trustee director

-

November 22, 2023

Continued rise in average annuity rates during third quarter of 2023

Average annuity rates continued to rise in Q3, according to the Standard Life Annuity Rate Tracker

-

November 21, 2023

Trustee Accelerator Programme

Standard Life targets the next generation of Trustees with the launch of the Trustee Accelerator Programme

-

November 17, 2023

Cost-of-living crisis is main barrier for two fifths of over 50s approaching retirement

Research from Standard Life shows barriers for over 50s approaching retirement

-

November 09, 2023

Beware the cost of parenting crisis

Standard Life research highlights the pressure on parents

-

October 31, 2023

3-year pension contribution break could result in £36k less in retirement

Standard Life analysis finds even a short payment pause could have big retirement consequences

-

October 26, 2023

Have you lost track of your pensions?

Ahead of Pension Tracing Day, Standard Life finds many are unaware they can bring their pots together

-

October 24, 2023

Standard Life research shows half of DB scheme trustees now have an endgame strategy but barriers to delivering it remain

Half of DB scheme trustees now have an endgame strategy but barriers to delivering it remain according to research from Standard Life, part of Phoenix Group

-

October 23, 2023

A third of UK people feel they have made poor financial decisions recently

Standard Life sponsored research highlights falling financial confidence

-

October 19, 2023

How to supercharge your savings with on-off contributions

Even relatively small contributions can be powerful, Standard Life finds

-

October 17, 2023

Pensions are Brits’ lowest ‘life admin priority’

Pensions are bottom of the to-do list, but your future self might thank you for a quick check

-

October 11, 2023

Standard Life announces the completion of £335m buy-in with the London Stock Exchange Group Pension Scheme

Standard Life, part of Phoenix Group, has concluded a £335 million Bulk Purchase Annuity (“BPA”) transaction with the London Stock Exchange Group Pension Scheme (“the Scheme”).

-

October 10, 2023

Retirement countdown begins at 36 – is it early enough?

Standard Life’s new Retirement Voice report finds a mid-thirties financial turning point

-

October 05, 2023

Becoming self-employed? Remember your pension

Standard Life shares key pension points when moving from employed to self-employed

-

September 27, 2023

Only 1 in 10 IFA’s supportive of proposed pension death benefit changes

Standard Life research finds an underwhelmed response to the plans

-

September 23, 2023

Standard Life confirms plans for pensions dashboard

Standard Life strengthens partnership with Moneyhub and announces plans to deliver commercial pensions dashboard

-

September 20, 2023

Boosting pension contributions could leave you £115,000 better off in retirement

This Pensions Engagement Season, Standard Life analysis shows the long-term impact of different employer pension packages on retirement outcomes.

-

September 19, 2023

Annuity rates reach highest levels in two decades – but half of over 50’s still don’t fully understand how annuities work

New research from Standard Life, part of Phoenix Group, has revealed stark misunderstandings about annuities, including their usage and value

-

September 18, 2023

Andy Curran comments on Phoenix Group’s Half Year 2023

Andy Curran, CEO of Standard Life, comments on Standard Life’s contribution to Phoenix Group’s Half Year Results 2023

-

September 18, 2023

Kunal Sood comments on Phoenix Group’s Half Year 2023

Kunal Sood, comments on the half year success of Standard Life’s DB Solutions business as Phoenix Group publishes its half year financial results

-

September 13, 2023

1 in 10 UK fear their more vulnerable relatives have lost money through poor financial decisions

Research from AKG, sponsored by Standard Life shows scale of family concern

-

September 12, 2023

Starting pension contributions as early as possible pays off in retirement

Standard Life analysis highlights the potential power of compound investment growth

-

September 06, 2023

Andrew Davies joins Standard Life’s Independent Governance Committee

Andrew takes up the role of Communications & Engagement Value for Money Lead on the IGC.

-

September 05, 2023

People are nearly three times more likely to top up cash savings with spare money than their pension

Standard Life outlines the benefits of different savings options for both-short and long-term

-

September 04, 2023

Standard Life launches new individual annuity to meet increasing desire for a guaranteed income in retirement

Standard Life, part of Phoenix Group, today announces the launch of the Standard Life Pension Annuity, designed to meet an increasing need for certainty and security among those approaching or at retirement

-

September 04, 2023

Savers chase higher rates while borrowers look for signs of falling mortgage costs

Standard Life’s Search Radar shows 172% increase in searches for the best savings account in July

-

August 31, 2023

Boosting pension contributions after paying off your mortgage could mean £52,000 more in retirement

As long mortgage terms gain popularity, Standard Life analysis highlights the retirement trade-off

-

August 23, 2023

Illiquid assets a key focus for DB pension trustees targeting bulk purchase annuities

Improvements in funding levels have accelerated the need for many Defined Benefit (DB) pension trustees to consider the illiquid assets in their schemes, according to research from Standard Life, part of Phoenix Group.

-

August 17, 2023

How to stay safe from pension scammers

What you should know to protect your long-term savings

-

August 09, 2023

Advisers report clients withdrawing funds to plug financial shortfall

AKG research, sponsored by Standard Life, highlights the UK’s continued cost-of-living pressure

-

August 07, 2023

Four fifths of Defined Benefit (DB) pension scheme trustees expect to approach an insurer about de-risking within five years

A surge in bulk annuity deals is anticipated over the next five years, with over four fifths (86%) of pension scheme trustees expecting to approach an insurer in the next five years, according to new research from Standard Life, part of Phoenix Group.

-

August 02, 2023

Standard Life appoints Callum Stewart to Head of Investment Proposition Development

Dedicated investment solutions’ expertise for Standard Life’s workplace business

-

August 01, 2023

Rising interest rates boost positivity around cash savings while property confidence falls

Standard Life highlights the impact of current market conditions on different investments

-

July 31, 2023

Mega-transactions, deferred premiums and full-scheme deals are set to dominate the DB de-risking market during the second half 2023

Kunal Sood, Managing Director of Defined Benefit Solutions & Reinsurance at Standard Life identifies key trends in the DB de-risking market during the second half 2023

-

July 27, 2023

Standard Life completes £1.2 billion buy-in with Mitchells & Butlers Pension Plan

Standard Life, part of Phoenix Group, has concluded a £1.2 billion Bulk Purchase Annuity transaction covering c. 20,200 members of the Mitchells & Butlers Pension Plan

-

July 26, 2023

Standard Life outlines key considerations around how and when to take tax-free cash

Splashing the (tax free) cash: Over 55s expect to spend a third of their pension Tax Free Cash within six months of withdrawal

-

July 20, 2023

Annuity rates increase by 20% in the last twelve months adding over £25,000* to lifetime income

Standard Life Annuity Rate Tracker shows rates have increased by 20% since June 2022 with a total increase of 48% since the start of 2022

-

July 19, 2023

Standard Life announce winners of second Innovation Forum contest

Winners selected for their innovative approach to engaging people with their pensions

-

July 19, 2023

Standard Life reinforces commitment to its Retirement Solutions Commercial and Technology strategy with two senior hires

Standard Life, part of Phoenix Group, has announced two new senior appointments into the Commercial team that supports its Retirement Solutions business

-

July 17, 2023

Standard Life appoints Amy Madden as Customer Office Director

Amy’s appointment cements Standard Life’s commitment to driving a market-leading customer experience

-

July 11, 2023

Standard Life responds to DWP proposals

Our view on the consultations, responses and policy papers published on the 11th July

-

July 05, 2023

Standard Life completes £1 billion buy-in transaction with Chubb Pension Plan and Chubb Security Pension Fund

Standard Life, part of Phoenix Group, has concluded a £1 billion Bulk Purchase Annuity (“BPA”) transaction covering two schemes, the Chubb Pension Plan and the Chubb Security Pension Fund.

-

July 04, 2023

Nearly a fifth of over 55’s plan to pass their Tax Free Cash to loved ones

Standard Life analysis finds people willing to stay away from their cash to avoid IHT.

-

July 03, 2023

Standard Life appoints new Head of Financial Education and Communication

Andrew Pearson’s appointment cements Standard Life’s Financial Wellbeing focus

-

June 29, 2023

Starting pension saving early can outweigh the later life boom

Standard Life analysis demonstrates the benefit of consistent saving through a career.

-

June 27, 2023

2% increase in employer pension contributions could leave you £115,000 better off in retirement

Standard Life analysis shows why you should think about your pension package before accepting a job offer.

-

June 26, 2023

New Head of Retail Intermediary Distribution

Warren Bright’s arrival further strengthens the Retail Advised team.

-

June 19, 2023

Standard Life completes £80m buy-in with the MGM Assurance Staff Pension Plan

Standard Life, part of Phoenix Group, has concluded a £80 million Bulk Purchase Annuity transaction with the MGM Assurance Staff Pension Plan

-

June 16, 2023

Standard Life Search Radar highlights State Pension spike

State Pension top-up scheme and Budget lifetime allowance changes drive increase in internet searches

-

June 06, 2023

43% of over 55’s unaware they can take 25% of their pension tax free

Standard Life research finds a Tax Free Cash knowledge gap

-

June 01, 2023

Standard Life partners with Moneyhub to integrate open finance functionality

1.5 million workplace pension scheme members set to benefit Money Mindset, Standard Life’s open finance tool

-

May 31, 2023

Standard Life hosts first ‘Vulnerable Customer Summit’

Joint initiative with Scottish Financial Enterprise brings industry together to drive good outcomes for vulnerable customers

-

May 23, 2023

Sustained high inflation hits savers

Ahead of this week’s inflation figures, Standard Life analysis highlights the hit to cash-based savings

-

May 17, 2023

Young savers set for big retirement boost

Standard Life calculations show six-figure benefit of saving early

-

May 16, 2023

Women are more likely to only make minimum pension payments

Standard Life research explores a cause of the UK’s gender pension gap

-

May 11, 2023

Pension withdrawals and taxes explained

Standard Life’s guide to understanding tax when you access your pension

-

May 04, 2023

Standard Life Extends Master Trust with Launch of Retirement Section

Award winning Master Trust extended to employers and trustees of Single Employer Own Trust Schemes

-

May 03, 2023

The cost of growing up: financial responsibility doubles from 25 and continues beyond retirement

Standard Life research highlights the cost of growing up

-

April 28, 2023

Boosting pension contributions by 2% each month could lead to £108,000 more in retirement

Standard Life analysis highlights long-term impact of small payment increases

-

April 26, 2023

Current older workers plan to retire 7 years later than their predecessors

Standard Life research finds concerns around financial security could explain the gap

-

April 20, 2023

Search Radar: State Pension and pension tracing in high demand

Standard Life’s latest Search Radar show a huge increase in searches for both versus 2022

-

April 19, 2023

IFA’s mostly support budget changes but Lifetime Allowance doubts remain

Standard Life research finds majority of advisers happy with the pension changes but wary of banking on the LTA removal remaining

-

April 17, 2023

77% of UK adults not confident about how to access their pension

Standard Life shares a guide to taking your pension money

-

April 17, 2023

75% of UK adults don’t know how much is in their pension pot

Standard Life research highlights the country’s pension knowledge gap, and what we can do about it

-

April 12, 2023

Part-time workers face pension penalty of up to £119,000

Standard Life analysis shows switching from full-time work to working part-time 3 days a week could lead to £119,000 less in retirement

-

April 11, 2023

Boom in IFA client enquiries following Budget pension changes

45% of IFAs report increase in enquiries following Budget pension bombshell

-

April 05, 2023

Most state benefits are about to rise by 10.1% - make sure you check your eligibility

Standard Life’s guide to claiming your full entitlement as benefits rise with inflation

-

April 03, 2023

Business optimism abounds as advisers contemplate challenges in the months ahead

Standard Life’s research highlights challenges concerning financial advisers

-

April 03, 2023

Full State Pension will be 84% of the tax-free Personal Allowance from 6 April

Rise in the State Pension will be welcome, but Standard Life analysis highlights the potential tax implications

-

March 30, 2023

Standard Life comments on DC Pensions Consultations

Standard Life’s view as the Value for Money, Collective Defined Contribution and Small Pots Consultations close

-

March 28, 2023

Standard Life announce new FinTech ‘Innovation Forum’

This year FinTech firms will work with Standard Life to boost engagement with responsible investing

-

March 27, 2023

Advised customers expect to retire three years earlier

Standard Life analysis highlights the benefits of seeking advice and planning ahead for retirement

-

March 27, 2023

Remember your pension this Tax Year End

Standard Life offers tips on how to maximise your pension savings this tax year, and how to prepare for the new one

-

March 08, 2023

Maggie Craig joins Standard Life Independent Governance Committee

Appointment extends Independent Governance Committee members to seven

-

February 23, 2023

Eleven-in-a-row interest rate rise threatens retirees

Recent analysis found 13% of retirees still rent of pay a mortgage, and could struggle as rates reach 4.25%

-

February 21, 2023

Property or Pension to fund Retirement?

Standard Life research shows a generational divide

-

February 21, 2023

One in Seven receive less State Pension than they expect

Standard Life analysis highlights extent of the State Pension knowledge gap

-

February 21, 2023

Market fluctuations and Pension Saving

As the FTSE 100 reaches record high, Standard Life analysis puts market fluctuations in context

-

February 07, 2023

Half of UK consumers find pensions information overwhelming as cost of living hits confidence

Standard Life analysis shows how financial uncertainty has led to a greater need for pension advice and guidance

-

February 02, 2023

Standard Life comments on today's 'Ten in a Row' interest rate rise

Standard Life analysis shows how rising saving returns and falling inflation could combine to help savers

-

February 01, 2023

Claire Altman, Managing Director for Individual Retirement at Standard Life comments on CDC Consultation

Claire Altman, Managing Director for Individual Retirement at Standard Life has commented on the Consultation on a policy framework for broadening Collective Defined Contribution (CDC) provision.

-

February 01, 2023

Standard Life comments on the DWP’s consultation on small pots

Standard Life favours a ‘pot follows member’ solution to the issue

-

January 31, 2023

Internet searches for ‘pensions’ spiked 16% in 2022

Standard Life analysis reveals consumer need for pension information

-

January 31, 2023

Standard Life appoints Jeetesh Patel as new Head of Reinsurance and Structuring

Standard Life, part of Phoenix Group, today announces a senior promotion within its Retirement Solutions business

-

January 26, 2023

2028 minimum pension age increase could boost your retirement pot by £22,000

The rise from 55 to 57 is controversial but Standard Life analysis shows how it could help you in retirement

-

January 19, 2023

The self-assessment tax deadline is the 31st January- what you should know

Standard Life help answer questions on the tax return and discuss why you should think of your pension

-

January 18, 2023

Cost of living ‘triple shock’ hits financial confidence

Standard Life research reveals extent of the damage- and tips on how to get some confidence back

-

January 05, 2023

Tips to get your finances in shape for 2023

Standard Life shares ways to get your finances ready for the new year

-

December 15, 2022

Standard Life show how much of your retirement income will come from the state pension

Analysis reveals the proportion of pension income that will come from the state pensions for different sized pension pots

-

December 06, 2022

Cost of living pressures bite as almost one in ten seek second job

New findings from Standard Life’s Retirement Voice study, capturing the views and attitudes to retirement planning and finances.

-

December 01, 2022

Standard Life uses high-tech Edinburgh Innovation Lab to highlight Vulnerable Customer Issues

New virtual reality technology joins suite of technology to bring challenges faced by savers to life

-

November 24, 2022

Standard Life analysis shows Google searches for annuities on the up as rates rise

Standard Life, part of Phoenix Group, has appointed Equiniti, to carry out administration of both buy-in and buy-out BPA (bulk purchase annuity) policies.

-

November 15, 2022

Standard Life analysis shows Google searches for annuities on the up as rates rise

New analysis from Standard Life shows increasing interest in annuities as rates climb by around 50% since the start of the year

-

November 09, 2022

Standard Life completes final stage of £15bn pension asset transition into sustainable multi asset solutions

1.5 million members invested in sustainable multi asset solutions, marks sustainable milestone for Standard Life

-

November 03, 2022

Over 230,000 people may have been underpaid the state pension

Standard Life share guide to help ensure you are receiving your full state pension entitlement

-

November 02, 2022

Standard Life completes 200m GBP buy-in transaction with the Agfa Group Pension Plan

Standard Life, part of Phoenix Group, has concluded a £200m Bulk Purchase Annuity transaction with Agfa UK Group Pension Plan.

-

November 01, 2022

Standard Life appoints Dean Butler as Managing Director of Retail Direct

Standard Life, part of Phoenix Group, has appointed Dean Butler to the newly created role of Managing Director of Retail Direct, signalling its continued investment in its Pensions and Savings business.

-

October 28, 2022

Standard Life appoints new Managing Director of Defined Benefit Solutions and Reinsurance

Kunal Sood has been promoted Managing Director of Defined Benefit Solutions and Reinsurance, responsible for driving growth of Standard Life’s Bulk Purchase Annuity (BPA) business. He will take over from Justin Grainger, who has been promoted to Commercial Finance Director.

-

October 27, 2022

Standard Life completes 530m GBP buy-in with the Cobham Pension Plan

Standard Life, part of Phoenix Group, has concluded a 530m GBP Bulk Purchase Annuity transaction covering c.3000 members of the Cobham Pension Plan

-

October 27, 2022

26.6bn GBP is sitting in lost pension pots ahead of National Pension Tracing Day 2022

With the value of lost pots soaring, Standard Life offers tips to help you keep on top of your pension savings.

-

October 24, 2022

Standard Life shares top tips to manage your pension

This pension Engagement Season, ensure you are getting the most out of your retirement savings

-

October 24, 2022

A quarter of workers unaware how much they pay into their workplace pension

Research commissioned by Standard Life highlights need for further auto-enrolment engagement strategies

-

October 20, 2022

Standard Life unveils major investment in the iconic brand

Standard Life has been selected as the new headline partner for Cancer Research UK's Race for Life. Combined with a new TV ad, the activity represents the most significant investment in Standard Life since the brand was acquired by Phoenix Group

-

October 12, 2022

Standard Life research highlights gaps in pension awareness

With auto-enrolment reaching its 10th anniversary, pension engagement differs across demographics

-

October 06, 2022

Standard Life appoints new members to Independent Governance Committee

Rachel Haworth, Jo Hill, and Andrew Milligan join IGC overseeing interests of 2.5 million workplace personal pension scheme members

-

October 04, 2022

Standard Life highlights the potential impact of updated auto-enrolment rules on retirement outcomes

Standard Life highlights the potential impact of updated auto-enrolment rules on retirement outcomes

-

September 08, 2022

267,000 GBP pension pot needed to replicate average retirement income as annuity rates increase

Analysis of government figures by Standard Life reveals the pot size needed- and with rising annuity rates, it’s not all bad news

-

August 31, 2022

Saving early, if you can, yields compound interest benefits

Standard Life analysis shows saving as early as possible has a positive impact, but there are trade-offs between near and longer-term financial priorities in the current climate

-

August 08, 2022

Standard Life completes 1bn GBP full scheme buy-in of the WH Smith Pension Trust

Standard Life, part of Phoenix Group, has concluded a 1bn GBP Bulk Purchase Annuity transaction covering c.13,000 members of the WH Smith Pension Trust

-

July 21, 2022

Standard Life completes 150m GBP full scheme buy-in of the Sappi UK Pension Scheme

Standard Life, part of Phoenix Group, has concluded a 150m GBP Bulk Purchase Annuity transaction covering 1,300 members of the Sappi UK Pension Scheme

-

July 18, 2022

Pausing pension contributions mean savers miss out on thousands in future

Standard Life highlights the long-term implications of pausing pension contributions during the cost-of-living crisis - a year-long break could be costly

-

July 13, 2022

Standard Life completes 680m GBP buy-in of the Whitbread Group Pension Fund

Standard Life, part of Phoenix Group, has concluded a 680 million GBP Bulk Purchase Annuity transaction covering c8,000 members of the Whitbread Group Pension Fund

-

July 05, 2022

Seven mistakes to avoid when you're aiming to build your pension pot

Standard Life shares mistakes it's important to avoid while you plan for retirement.

-

June 27, 2022

Standard Life lowers Pricing and overhauls Portal in ongoing adviser channel focus

Standard Life is introducing a series of upgrades to its pension pricing and revamping its digital services as part of strategic plans to rejuvenate proposition and service capability for financial advisers.

-

June 23, 2022

Savers suffer as analysis shows harsh impact of high inflation over sustained period

New Analysis from Standard Life shows impact of sustained high inflation on savers

-

May 16, 2022

Standard Life Appoints Managing Director of Retail Intermediary to New Senior Role

Appointment marks renewed investment, focus and commitment to the intermediary marketplace

-

May 03, 2022

Sustainable transformation for 87,000 Standard Life MT Members

Standard Life Completes the switch of 87,000 Master Trust members to its new sustainable fund, Sustainable Multi Asset

-

April 28, 2022

Focus on Active phase of retirement puts Brits at risk of later life financial shortfall

UK adults risk potential financial shortfall in later life by focusing on initial, active phase of retirement - New Research from Standard Life reveals

-

March 24, 2022

Standard Life completes 175m GBP full scheme buy-in of the Findel Group Pension Fund

Standard Life, part of Phoenix Group, has concluded a 175M GBP bulk purchase annuity transaction covering all members of the Findel Group Pension Fund

-

March 16, 2022

Gen Z gets its affairs in order at an early age as Will making habits revealed

Insight from Standard Life reveals that as many as 20% of young adults aged 18 to 24 have already made a Will.

-

March 11, 2022

Standard Life makes senior hire to its Defined Benefit Solutions team

Standard Life, part of Phoenix Group, announces the appointment of three hires to its Defined Benefit Solutions business, strengthening the company's Bulk Purchase Annuity capabilities.

-

March 03, 2022

Standard Life launches Joint Research Initiative with the OECD

The new initiative will examine the challenges people face regarding retirement income and identify approaches being used globally

-

February 15, 2022

Standard Life to offer a range of workplace ISAs in partnership with Cushon

The Standard Life Workplace Savings Proposition in partnership with Cushon will provide employers with the option of offering their employees access to a range of savings options from Individual Savings Account (ISA) and Lifetime ISA (LISA) to Junior ISA (JISA) and a General Investment Account (GIA).

-

January 27, 2022

Standard Life enhances workplace Client Analytics

Client Analytics' enhanced functionality gives employers, trustees and advisers unprecedented insight into the expected Retirement Living Standards of their workplace pension scheme members

-

January 20, 2022

Standard Life completes 1.7bn GBP full scheme buy-in with Gallaher Pensions

Standard Life, part of Phoenix Group, has concluded a 1.7bn GBP bulk purchase annuity transaction covering all members of the Gallaher Pension Scheme ("the Scheme").

-

January 14, 2022

Phoenix Group 4.0 billion of Bulk Purchase Annuity transactions

Phoenix Group completes 4.0 billion of Bulk Purchase Annuity transactions in H2 2021

-

January 13, 2022

Standard Life to move £15bn of assets and 1.5m pension customers to sustainable default strategy

Standard Life, part of Phoenix Group, has concluded a £200m Bulk Purchase Annuity transaction with Agfa UK Group Pension Plan.

-

January 13, 2022

Standard Life Completes 1.8bn GBP Bulk Purchase Annuity Pensioner Buy-In

Standard Life, part of Phoenix Group, has completed a 1.8bn GBP Bulk Purchase Annuity (BPA) transaction covering c.6,600 pensioner members.

-

October 25, 2021

Flexible New Lifetime Mortgage Product Range

Standard Life Home Finance, a brand used by Key Group as part of its partnership with Standard Life, today announces the launch details of a new range of innovative Lifetime Mortgage products.

-

October 21, 2021

PerkinElmer pension scheme buy-in

Standard Life completes 130 million pound full scheme buy-in for 900 PerkinElmer scheme members

-

October 06, 2021

Gen Z's caring nature revealed

Gen Z's caring nature revealed as 62% happy to spend less now to help their children and loved ones in future

-

October 05, 2021

Phoenix Group invests in Standard Life brand as part of ambitious growth plans

Investment plans unveiled for iconic Standard Life brand following purchase by Phoenix Group

-

September 15, 2021

Standard Life announces strategic partnership with Key Group

Standard Life announces a strategic agreement with Key Group to launch a Lifetime Mortgage product range called Standard Life Home Finance.

-

September 07, 2021

Standard Life launches Homebuyers Hub

Property ladder boost for Pension Scheme Members as Standard Life launches Homebuyer Hub.

-

August 23, 2021

Gen xers not confident

A third of Gen Xers not confident they'll be able to work for as long as they need to fund their retirement

-

July 05, 2021

Nearly 1 in 3 Gen Xers have inadequate pension savings

Nearly one in three Generation X members (those born between 1965 and 1980) face financial hardship in retirement due to having inadequate pension savings.

-

July 05, 2021

Thinking forward illiquids report

With 2 in 3 EBCs saying illiquid assets have delayed de-risking transactions, a new Standard Life report highlights the importance of careful planning by trustees before approaching the insurance market

-

June 02, 2021

Standard Life Launches In-Scheme Drawdown

Standard Life continues to enhance its workplace DC pension proposition with the launch of In-Scheme Drawdown for 1.5 million members.

-

December 10, 2020

Standard Life expands Responsible Investment range

Standard Life is expanding the range of Responsible Investment funds it offers to pension savers.

-

March 02, 2020

New board directors for SLMTC

Standard Life Assurance Limited today announces three new board appointments to the Standard Life Master Trust Co Ltd (SLMTC).

-

July 02, 2019

Standard Life awarded Master Trust Authorisation

Standard Life Assurance Limited today announces it has received authorisation from The Pensions Regulator (TPR) for its two master trusts.